- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

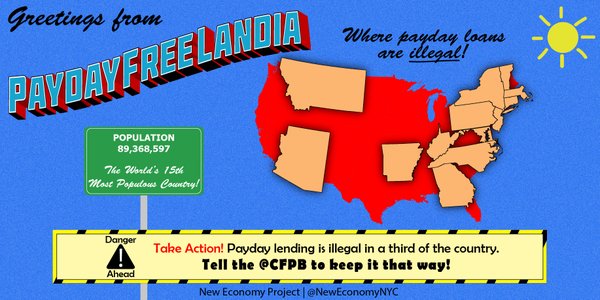

West Virginia has a proud history of keeping predatory payday lenders out of our state. This spring the Consumer Financial Protection Bureau (CFBP) will issue a rule to regulate the payday lending industry. Payday lenders are aggressively lobbying the CFPB and Congress to weaken and delay the rule.

Although payday lending is not legal in West Virginia, payday lenders have tried to evade our state laws by operating online, as well as using an assortment of other schemes. A loan shark in cyberspace is just as harmful as one on a street corner.

Payday lenders use shrewd marketing and friendly convenience to lure people into a deeper and deeper debt trap using interest rates of over 300%. When a bill expanding payday lending passed in Missouri a number of years ago, the Catholic Parish there found a 50% increase in demand on their food bank. The predatory tactics of the payday lending industry takes such advantage of people that they will get in debt to, and pay back, the payday lender before they buy food for their families.