- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

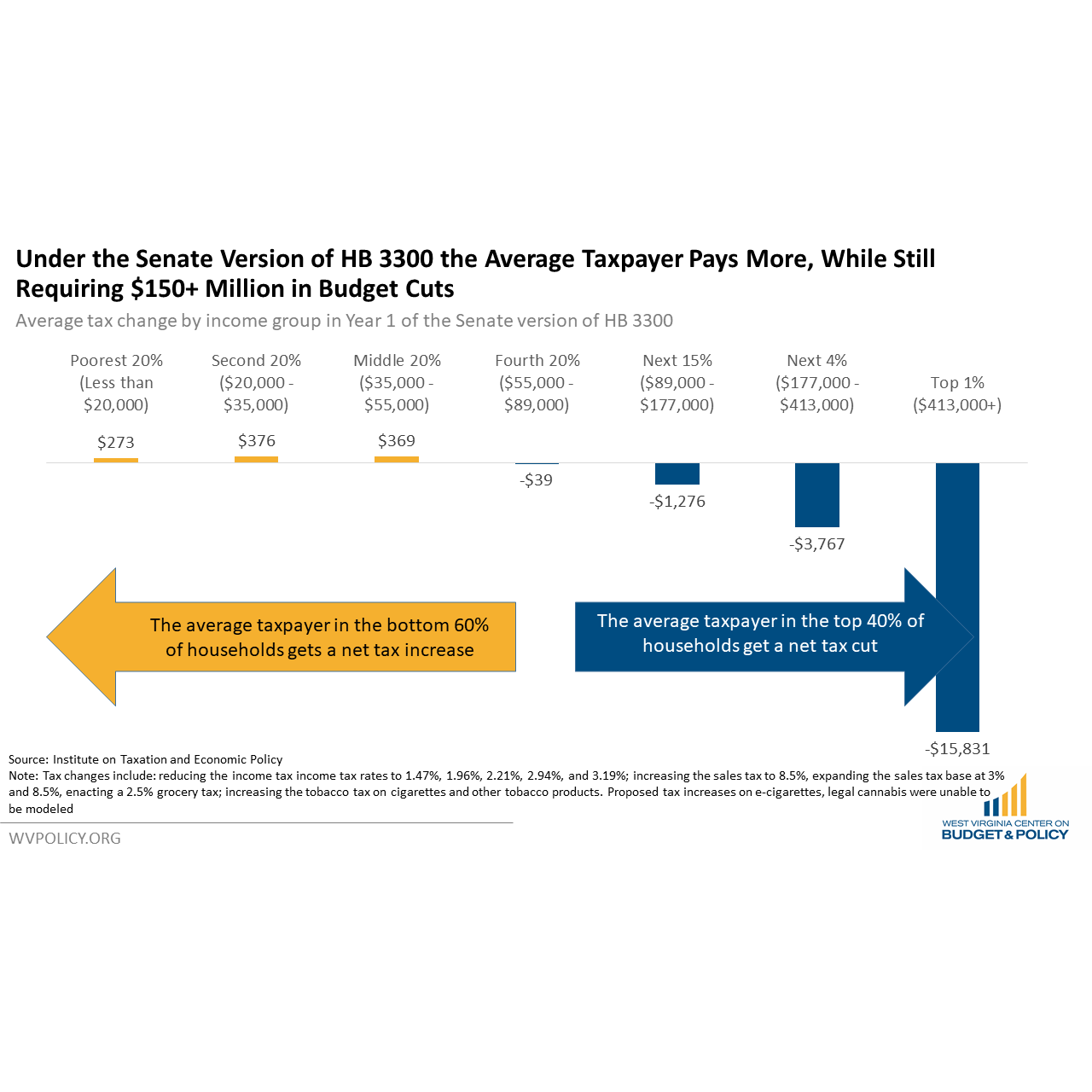

Finally, Sean’s analysis of the Senate tax bill is live. Please share!

Here are his key takeaways:

- In its first year, the Senate plan would be a net tax increase for the average taxpayer in the bottom 60 percent of households.

- Even with the income tax fully eliminated, the Senate plan would be a net tax increase for the average taxpayer in the bottom 40 percent of households.

- The typical household in West Virginia would see a net tax cut of only $27 when the bill is fully enacted.

- A household in the top one percent in West Virginia would receive a tax cut that is 1,252 times as large as that of a household in the middle 20 percent.

- The Senate plan would create a $1.4 billion hole in the budget within five years, requiring either further regressive tax increases or substantial budget cuts.

- The Senate plan would give West Virginia the highest state sales tax in the country.

- The Senate plan would make West Virginia one of the only four states to tax professional services.

- The Senate plan would make West Virginia one of only 14 states to tax groceries.

- The Senate plan would give West Virginia the fourth highest combined state sales and hotel tax in the country.