Sorry we have to wake you up from your weekend bliss to remind you it’s legislative session; nonetheless, it is…and we are visiting you early this week for some extra special urgent actions.

Take Action: Tell Your Legislators to Reject a Blank Check for Special Interests & Out-of-State Corporations

by Kelly Allen, Director of Policy Engagement, WV Center on Budget & Policy

We really need your help stopping SJR 9, a proposal up for a final vote on Monday in the Senate. SJR 9 would give the legislature a blank check to completely eliminate personal property taxes, a primary source of funding for public schools, county and local governments, and vital public services. Senate leadership has made clear that their intent for this bill is to eliminate the machinery and inventory tax for manufacturers and corporations, largely benefiting businesses headquartered out of state. This proposal is bad for a whole lot of reasons:

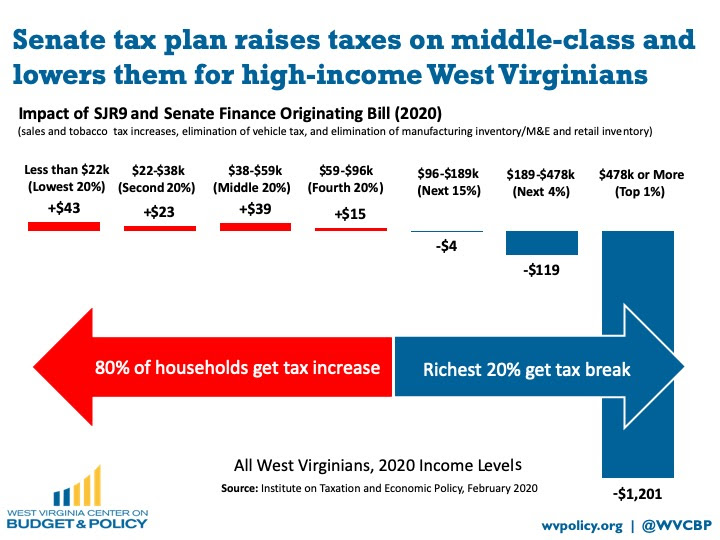

- It will make our state tax system even less fair. Any means of paying for this tax reduction, largely to benefit wealthy corporations, will fall on working West Virginia families- either by increased taxes on them or cuts to public services that we all rely on. Here is an analysis on the current proposal to raise the sales and tobacco tax, but it’s important to recognize that any proposal, including only passing SJR 9 and no funding mechanism, will fall on regular West Virginians.

- It takes autonomy away from local governments and public schools systems and sends it to Charleston. If the legislature eliminates this tax, local governments will have to jockey for state funding to make them “whole” again, and likely face cuts considering our state budget picture in future years already has large gaps. See more in Sean’s report on our troubling budget outlook.

- It gives a “blank check” to future legislatures by taking away the constitutional provision that property is equally taxed regardless of the industry or who owns it- with the potential of blowing a $550+ million hole in future budgets, impacting state, county, and local governments’ ability to function.

What can you do right now?

- Sign onto the petition urging your House + Senate legislators to stand firm and vote NO.

- Share WVCBP’s Facebook post.

- Call your Senators and leave a message urging them to vote no on Monday.

Thanks so much for your quick attention to this matter!

Public Hearing: No Religious Instruction in Public Schools

by Joseph Cohen, Executive Director, ACLU-WV

State lawmakers seem hellbent this session on pushing their religious views into our public school system. In doing so, they are waging an onslaught against the rights of religious minorities.

Religious instruction is the job of parents and faith leaders, not public school employees. And yet, FOUR bills are moving this session that would allow teachers to instruct from the bible.

It is virtually impossible to implement a biblically-based curriculum in a public school that complies with the Constitution, even with the best of intentions. All courses offered at public schools – whether mandatory or elective – must be secular, objective, non-devotional, and must not promote any specific religious view.

We need you to make your voice heard at a public hearing at 9 a.m. on Monday, February 24 at the state Capitol. Tell the Legislature that religious instruction belongs in the home and in houses of worship, not in public school classrooms. Tell them that government officials should not be telling our children which religious beliefs are true and which aren’t.

Those who wish to speak at the public hearing need to arrive and sign in to speak at least 15 minutes before the start of the hearing.

Thanks for sticking with us!