The House quickly passed the governor’s bad idea of eliminating one quarter of our state’s annual revenue by cutting 50% off personal income taxes over the next three years. This is great for Governor Justice as he’s the wealthiest resident of our state and will gain the most. It’s also a great kickoff for his Senate campaign (as yet not officially announced) against Senator Joe Manchin. However, it’s terrible for the average West Virginian and our state for so many reasons:

#1: The huge hole in the budget created by this cut is proposed to be filled with our budget surplus, which is based on one-time federal rescue funds and inflated extraction industry revenues. When these run out, we’ll be forced to increase other taxes (10% Sales Tax?) and/or to make devastating cuts essential state programs like education and healthcare.

#2: It’s designed not to fully kick in until after the next governor is in office, giving the next administration the headache of cleaning up this pre-planned crisis.

#3: It would make our income tax more regressive, as it gives the most to the wealthiest (like our governor), and the least to those who have the least – and will ultimately force increases in other regressive taxes.

However, Senate leadership has deemed HB 2526 DOA and, not to be outdone, they’re cooking up their own tax cuts (more here and here). We’re hearing it’s a workaround to revive bad old Amendment 2, which voters soundly rejected last November. Essentially, they want to take the governor’s idea of a state tax rebate on the personal property taxes for vehicles, and extend it to inventory and equipment, as a way to codify the business tax cuts that voters nixed. This is still a terrible idea for all the reasons that led to the Amendment’s defeat.

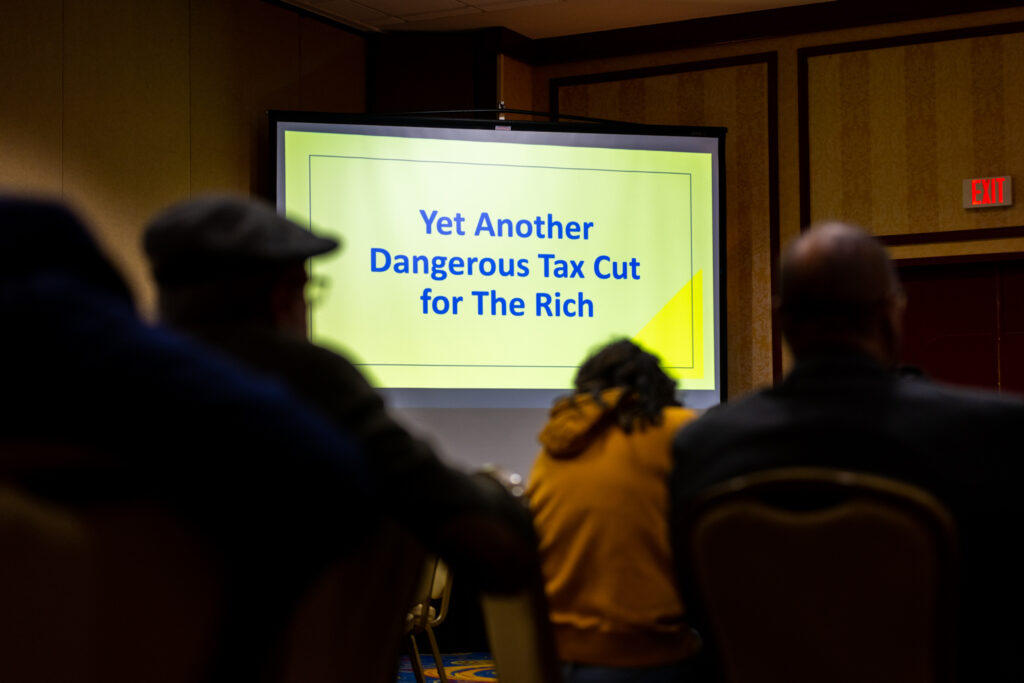

For a deep dive into this issue check out the video and/or slides from the WV Center on Budget and Policy’s Budget Breakfast with Sean O’Leary and national speakers. This year’s theme was ‘Unmet Needs’ outlining how the flat line budgets of the Justice Administration have, in reality, been yearly cuts in funding for all the essential functions and services of our state government. Their data shows exactly why both House and Senate proposals will do even more harm.🙁 Our Citizen Action Education Fund was proud to once again sponsor this annual event.

Regardless of how the Legislature lands on these cuts, regular West Virginians lose. Now is the time to make your voice heard on this lose-lose proposition! Here is a handy action link you can use to let your lawmakers know that you value the services that your taxes support and to say NO to unaffordable cuts to state revenue to give the wealthy and big out of state corporations more tax breaks!