On March 7th, advocates gathered at the Capitol to draw attention to the many justice and fairness issues legislators have either ignored or worsened this session, and to demand that a portion of the state’s remaining American Rescue Plan Act funds be invested in West Virginia families and communities. ARPA represents a rare and historic opportunity to invest in strategic projects to address poverty and other social determinants of health in West Virginia’s poorest communities.

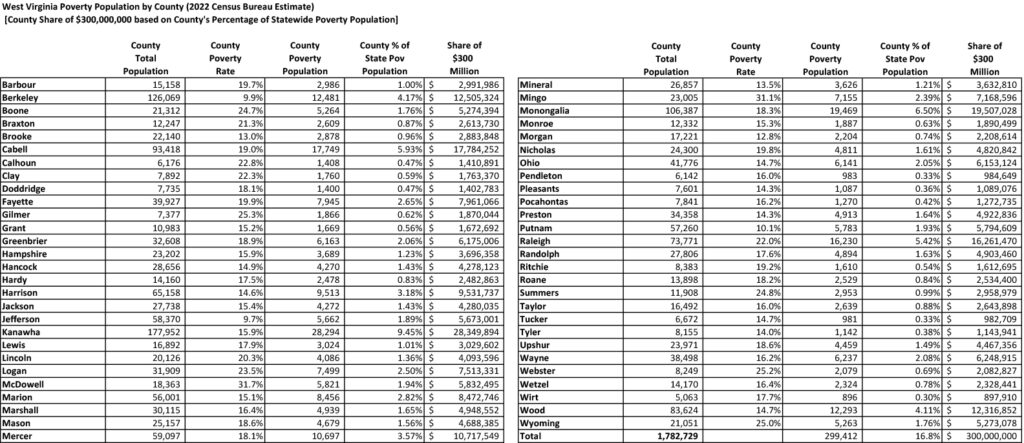

The Tuesday Morning Group, a Charleston faith-based network, has proposed an Economic Justice, Fairness and Equity plan to distribute $300 million across all 55 counties, based on each county’s percentage of the statewide poverty population.

The day before the Economic Justice and Fairness Rally, the House Finance committee announced it would be considering HB 2883, Making a supplemental appropriation from the Coronavirus Fiscal Recovery Fund, in which Governor Justice proposed using the remaining ARPA funds to send $500 million to the state’s Economic Development Authority for use in its Economic Development Project Fund and $177 million to the Water Development Authority for water and sewer infrastructure. The allocation to the economic development authority is particularly concerning, as it does not meet the outlined intent of ARPA funds.

Another bill, HB 3545, introduced by Delegates Mike Pushkin, Larry Rowe and Danielle Walker, would allocate funds throughout the state based on the TMG proposal. Delegate Rowe and Delegate Doug Skaff offered amendments to HB 2883 in the Finance Committee to provide for direct investments in our communities but the amendments were voted down.

Although there was debate on the House floor about whether economic development was the best, highest and proper use of the remaining funds, the bill ultimately passed the House 79-17, and passed the Senate unanimously.

Members of the Legislature had an opportunity to do something historic and to leave a lasting legacy that they did something to address poverty across West Virginia. By rubber stamping the Governor’s proposal, they abdicated their responsibility and failed to do their due diligence to ensure the proposal they passed doesn’t put the state at risk of having federal funds clawed back. HB 2883 would do nothing to increase equitable outcomes as ARPA funds are meant to do. Instead, it would ensure more the same — big handouts to corporations at the cost of investments in the very communities ARPA funds were intended to serve.

Members of the Legislature had an opportunity to do something historic and to leave a lasting legacy that they did something to address poverty across West Virginia. By rubber stamping the Governor’s proposal, they abdicated their responsibility and failed to do their due diligence to ensure the proposal they passed doesn’t put the state at risk of having federal funds clawed back. HB 2883 would do nothing to increase equitable outcomes as ARPA funds are meant to do. Instead, it would ensure more the same — big handouts to corporations at the cost of investments in the very communities ARPA funds were intended to serve.

Despite passage of the bill, it’s not too late for the Governor to simply do the right thing and invest a portion of remaining ARPA funds in low income communities to build a stronger, more equitable economy as laid out in the ARPA guidance.

Call Governor Justice at 304-558-2000, OR email him at governor@wv.gov TODAY

and tell him NOT to let this historic opportunity to invest in our communities slip away!

Talking Points for Calls and Emails to Governor Justice Regarding HB 2883:

Topline #1: ARPA funds are intended to go to those communities most impacted by the pandemic and those who face long standing economic and health disparities. The Governor’s proposal to send most of our state’s remaining ARPA funds to economic development does not meet those goals.

Proof point 1: The ARPA Fiscal Recovery Funds provide resources for governments to meet the public health and economic needs of those impacted by the pandemic in their communities, as well as address long standing health and economic disparities, which amplified the impact of the pandemic in disproportionately impacted communities, resulting in more severe pandemic impacts.

Proof point 2: A large portion of the first half of ARPA funds ($315 million) went to a corporate handout to NUCOR Corporation. The remaining funds should go to meeting the needs of West Virginia families instead of sending more to big corporations through the economic development project fund.

Topline #2: West Virginia’s Fiscal Recovery Plan outlined a commitment to community engagement and equitable outcomes in its use of ARPA funds. To date, we’ve not seen any public input incorporated into the ARPA allocation plan.

Proof point 1: While the Herbert Henderson Office of Minority Affairs did a statewide ARPA listening tour, to date the results of that listening tour are not publicly available and presumably did not inform the ARPA spending request.

Proof point 2: The Department of Treasury also recommends public input as part of ARPA spending priorities. The interim final rule “urges state, territorial, tribal, and local governments to engage their constituents and communities in developing plans to use these payments, given the scale of funding and its potential to catalyze broader recovery and rebuilding.

Topline #3: The Tuesday Morning Group submitted a proposal to Governor Justice and Legislative Leadership requesting ARPA funds be used to support their “Economic Justice, Fairness, and Equity Plan” with no response. We are in support of that plan as it would achieve equitable outcomes as laid out in the ARPA guidance.

Proof point 1: The TMG plan would target $300 million of remaining ARPA funds to communities based on their share of the total number of residents living in poverty statewide.

Proof point 2: The current proposal for the state’s remaining ARPA funds does not target populations who have faced long standing health and economic disparities.

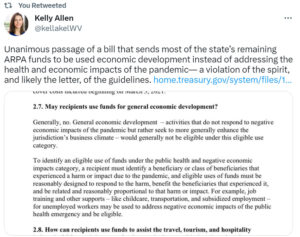

Topline #4: Governor Justice’s proposal to send ARPA Fiscal Recovery Funds to the Economic Development Authority may explicitly violate ARPA guidelines and does not appear to be an allowable expense. This puts the state at risk of having to pay back these federal funds.

Proof point 1: Under the final rule, there are four categories of allowable expenses: replacing lost public sector revenues; public health and economic response; premium pay for essential workers; and water, sewer, and broadband infrastructure. Loans and grants are only allowable to small businesses impacted by the pandemic, and then only to mitigate financial hardship or to support technical assistance for disproportionately impacted small businesses. Capital investments are only allowable under similar scenarios and require written justification to the Treasury unless going directly to schools, affordable housing, or the health care sector.