- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

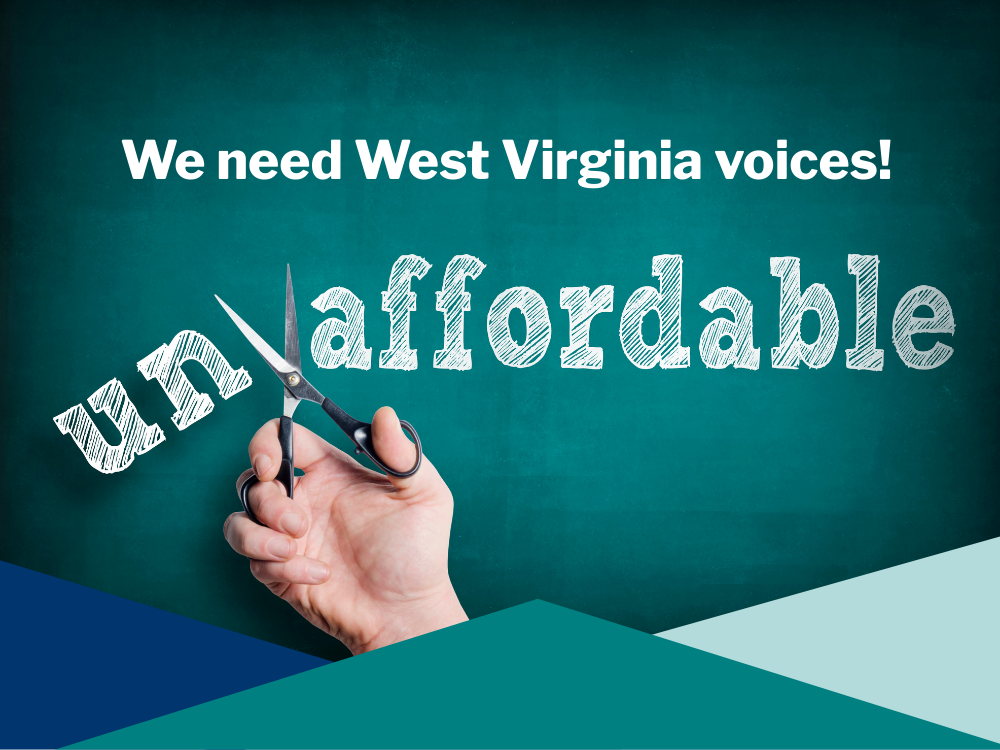

One thing we have learned through this COVID-19 pandemic is the importance of fully funding critical public services like health care and education, yet somehow GOP lawmakers are considering a proposal that would shift tax responsibility from the wealthiest residents to those who’ve suffered the worst effects of the pandemic: low-income families, Black and brown West Virginians, and women.

What’s most interesting is that our Governor, Jim Justice, the wealthiest man in WV proposed this tax reform just one day after he was re-elected as our Governor. West Virginia’s personal income tax is our fairest tax, ensuring that wealthier taxpayers pay their fair share and funding 43% of our state budget. Regressive tax cuts, like efforts to reduce or eliminate the income tax, will necessarily raise other taxes on low- and middle-income families and result in cuts to public services that benefit all families and businesses.

The leaked GOP House proposal to eliminate the income tax and raise sales taxes outlined by House Republicans would lead to an overall tax increase for 60% of West Virginians, while still requiring $900 million in budget cuts.

If you value prioritizing West Virginia’s families and communities over tax cuts for the most affluent, join us in sending a letter to legislators urging them to invest in our state’s future: “Protect the Personal Income Tax” Sign-on Letter.

For further context, you can also check out this recent WV Gazette Article.

We need all hands on deck, our voices must be heard on this very critical and urgent issue. We can make our voices more powerful by coming together to protect the personal income tax.

Please sign the above letter, which will send an email directly to you representatives. Additionally, please consider making a phone call to your representatives office asking that they “vote no on any reductions, reformation or elimination of the personal income tax.” You can find their contact information at www.wvlegislature.gov by clicking House/Delegates and Senate/Senators for complete listings.