- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

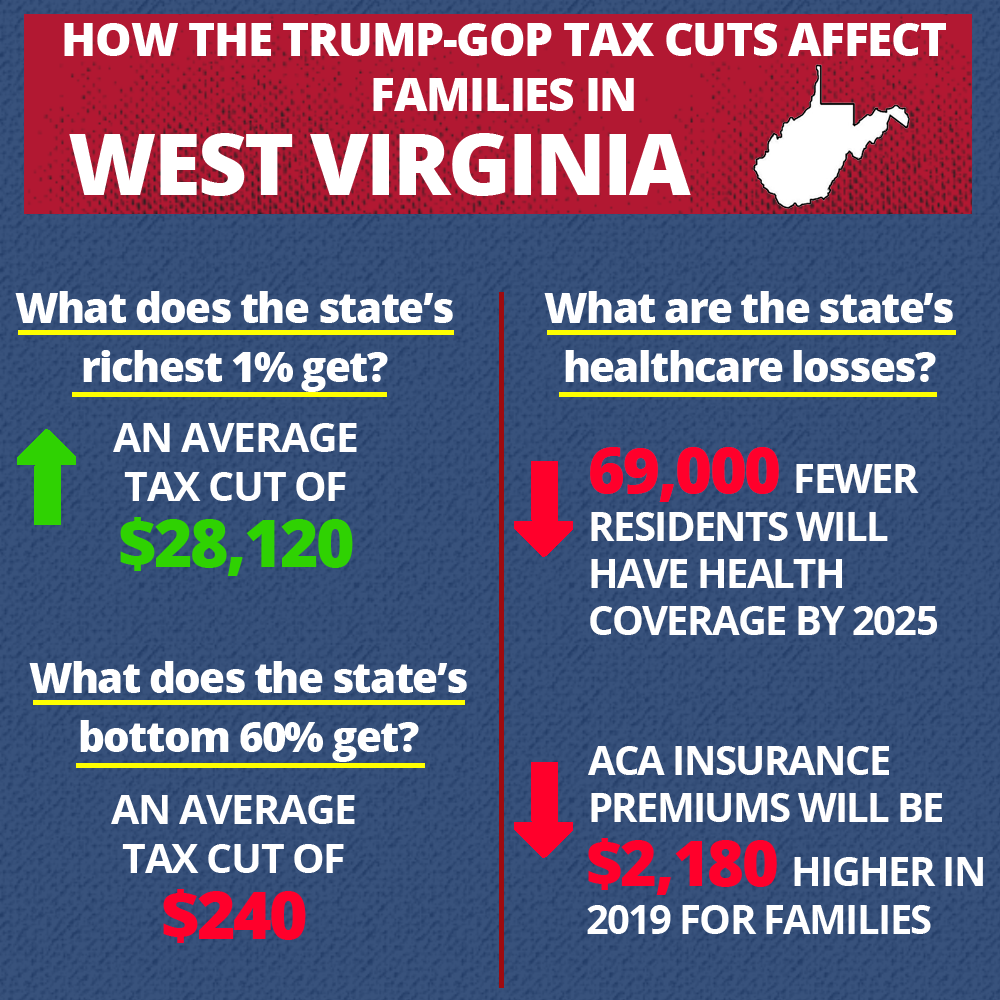

New ‘Tax Day’ Study Reports on How Trump’s Tax Law Enriches Corporations and Wealthy While Putting Health Care and Public Services at Risk

All but One in WV’s Delegation Voted for Tax Breaks for Rx and Insurance Co.s,

Higher Health Care Costs and Service Cuts for WV’s Working Families

Contact: Gary Zuckett, WV Citizen Action Group, 304-437-3701 (cell)

Charleston, WV – Citizen Action Group co-released a report today outlining the costly consequences of last December’s tax law that the Congressional Budget Office (CBO) predicts will add nearly 1.9 trillion to our national debt. “This huge giveaway to Wall Street, foreign corporations and billionaires in the tax law overshadows the pittance doled out to working families,” commented Gary Zuckett, Executive Director of WV Citizen Action. “Even worse, this self-inflicted deficit is now being used as an excuse for new attacks and cuts to our health care and other social programs that aid working families and low-income citizens.”

The new Tax Cuts and Jobs Act became law after passing the House and Senate late last year despite widespread constituent opposition and record-low public approval ratings. All of WV’s Congressional delegation except for Senator Joe Manchin voted for this ‘bait & switch’ bill.

The new law provides about $1.5 trillion in tax breaks to individuals and corporations with about two-thirds going to the richest 20% of households this year and nearly 83% of tax benefits going to the richest 1% by 2027 when the law is fully implemented. The law also permanently cut corporation’s tax rate from 35% down to 21%, gives companies who offshore profits a discount on taxes and eliminates some taxes on foreign profits.

Today, WV Citizen Action released a new West Virginia report by Americans for Tax Fairness and Health Care for America Now detailing the affects of the tax cut package on families in West Virginia and compares that with the tax benefits that health insurance companies and prescription drug manufacturers receive under the same law.

Read the West Virginia report here:

According the report’s findings:

- The richest 1% of WV taxpayers— will receive 25% of the state’s total tax cut.

- The bottom 60% of taxpayers—people with income less than $52,000 will get just 13% of the tax cuts.

- The average tax cut for the richest 1% is over $28,000 while the average tax benefit for the lower 60% of West Virginians is $240 —less than a dollar a day.

Most health industry companies including the largest pharmaceutical companies like Merck and Pfizer will get massive tax breaks, but will not pass these on to their employees in the form of wage increases or bonuses. The same is true for insurers like UnitedHealth, which will receive $1.7 billion in annual tax breaks but likely not pass these benefits on to customers in the form of lower costs.

On the contrary, because the corporate tax cuts in the new law are paid for with cuts to the Affordable Care Act (ACA), millions will actually see increased costs for coverage. Repeal of a key provision of the ACA in the tax law will increase the number of uninsured people in our state by 69,000 and drive up premiums by as much as $2,100 annually for some ACA enrollees.

“Tax breaks for the rich and corporations, especially at this scale, are an expensive luxury. That money has to come from somewhere,” said Zuckett. “In this case, Republicans have cut the ACA—a law they want to get rid of anyway—to pay for a large portion of the tax cuts which means that the cost really gets shifted to consumers and states in the form of higher premiums and rising numbers of uninsured people that put a burden on our state’s resources.”

The analysis also shows the impact of additional proposed cuts to public programs like Medicaid, Medicare, Social Security Disability Insurance (SSDI), SNAP and education that President Trump proposed earlier this year to address the $1.9 trillion that CBO (Congressional Budget Office) predicts the tax law will add to the deficit. Trump’s budget proposal will impact millions in West Virginia:

- Nearly 200,000 could lose health coverage because of the proposed full repeal of the Affordable Care Act. Women, people over 50 and people with pre-existing conditions would lose important protections that stop insurance companies from charging them more. Seniors could also face higher costs for prescription drugs because of a key provision in the ACA that gives seniors in Part D a discount on prescription medicines.

- 40,000 people in West Virginia could lose food assistance through SNAP.

- Nearly 180,000 could lose services because of a $727,075,958 cut to SSDI and SSI.

- West Virginia would lose $1 billion from highway funding and $115 million from transit funding between 2021 and 2027, resulting in significant job loss.

- 46,000 college students could lose federal student aid, and 9,600 kids could lose after-school programs.

The only way to fix this looming catastrophe is the repeal of the new tax law. This must be done in order to protect health care, education and public services from more cuts. This is a heavy lift in the current Washington climate. However, there is an election in November and more citizens are becoming activated now than any time since Vietnam. We’ll be working to make sure they “Remember in November!”

“Instead of more tax breaks that reward prescription drug companies and insurers for decades of gouging customers, our representatives in Congress should be making corporations pay their fair share of taxes to expand health care, make insurance and prescription drugs more affordable, and protect education, Medicaid, Medicare and Social Security,” concluded Zuckett.

###