- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Trump’s Plan to Fund More Tax Breaks for the Wealthy by Cutting Health Care for Millions Repudiates MLK’s Legacy and Takes America Backwards

Contact: Gary Zuckett, Co-Director, garyz@wvcag.org, 304-437-3701

Charleston WV – As Donald Trump begins his second presidential term on Martin Luther King Day, the contrast between the two leaders couldn’t be starker. Trump and his fellow Republicans in Congress have made it their top priority to slash healthcare and other vital public services for working families to fund trillions in tax cuts for the ultra-wealthy and large corporations. King, the civil rights icon and working families champion, envisioned a democracy of equal opportunity in which everyone in America, no matter where they live or what they look like, has access to affordable healthcare they can count on, public education, safe housing and other basics average people need to prosper in today’s economy. In contrast, President Trump and GOP leaders in Congress are promoting policies that help the rich get richer at the expense of everyone else.

Trump and the GOP already cut taxes mostly for the rich and corporations the last time they controlled Congress, in 2017. Nationwide, billionaires have added $3.9 trillion to their collective wealth in those seven years, according to an ongoing tally by Americans for Tax Fairness using Forbes data. Tax breaks for the wealthy under the TCJA added $2 trillion to the national debt, while doing little to create jobs or benefit average income people struggling with rising prices and high costs.

Many of the same Republicans who voted for the law are now citing record high debt as an excuse to cut Medicaid, Medicare, the Affordable Care Act and other public investments that increase economic security for working families.

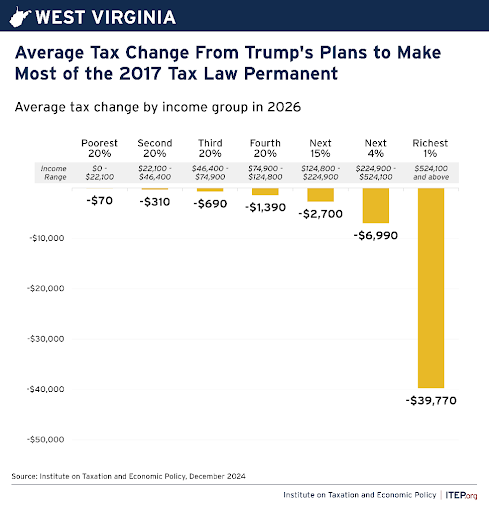

Most of the Republican tax law expires at the end of this year, but Trump and some leaders in Congress want to permanently extend it at a further cost of $5.5 trillion. The bulk of these breaks will continue to go to the rich, while working families will face higher health care costs, loss of critical services and bigger future deficits.

“I feel sure the man whose birth we celebrate this day, Dr. King, would be outraged by the tax-and-spending plans of the man we swear into office this same day, Mr. Trump,” said Gary Zuckett, Executive Director of WV Citizen Action, “The astronomical wealth growth of billionaires around the country in the seven years since the Trump-GOP tax law was enacted is a clear indication of who the Trump tax cuts were meant to serve–and who will benefit if Congress permanently extends those cuts. It’s also clear who will pay for more tax breaks for the rich: working families across the board will suffer under an extended tax law even as our economy becomes more unequal, as the racial and economic divides deepen, and we teeter further and further away from Dr. King’s dream.”

Many price-gouging corporations will also continue to benefit disproportionately under the Trump tax law. The centerpiece of the 2017 tax law was a two-fifths cut in the corporate tax rate, from 35% to 21%. Corporations didn’t need a tax cut since they were already enjoying record profits and their share of federal revenue they contributed had substantially shrunk in the past few decades. Trump and the GOP claimed their big corporate tax cut would trickle down to workers and communities, but instead it’s been used to further enrich wealthy C EOs and shareholders even as consumers faced persistent inflation and price increases on everything from rent to groceries. The corporate tax cut is one of the main reasons the Trump-GOP tax law was so slanted towards the richest 10% of Americans who own 93% of all corporate stock.

Healthcare corporations like UnitedHealth Group were among the firms experiencing record profits even as premiums and out of pocket costs continue to rise.

Extending the Trump tax breaks will only make things worse, heaping more benefits on those who need them least while cutting healthcare for people of all ages, shifting costs to families and widening the gulf between millionaires, billionaires and the rest of us. In our state alone the richest 1% of households would get a $39,000+ annual tax cut, while the bottom 60% would get an annual average $865 ($2.37 a Day – enough to buy a cheap cup of coffee) if Trump and Congressional Republicans get their way.

More tax breaks for the wealthiest households and large corporations take our nation in the wrong direction by doubling down on inequality, making cuts in the critical resources that families depend on most and rolling back progress on health and economic security. The Republican proposal to extend tax breaks for the wealthy, for instance, would strip millions of healthcare coverage under the Affordable Care Act (ACA). Although premiums are still too high for some households and businesses, improvements to the ACA tax credits have expanded coverage and made insurance more affordable for millions more people over the last several years, saving enrollees an average of $700 in 2024 and resulting in record enrollment numbers.

Improvements in healthcare coverage under the ACA and Medicaid have resulted in record low numbers of uninsured people but some policies are set to expire at the end of 2025.

Republicans are already refusing to extend enhanced tax credits that benefit 92% of people who buy ACA coverage. Without these, premiums will shoot up for millions of ACA policyholders, increasing by over 75% on average for ACA enrollees. In some states, patients will see costs more than double, making coverage unaffordable

An Urban Institute study estimates that around 4 million people would lose coverage altogether and be uninsured if the enhanced premium tax credits expire. Low income people and people of color would see the greatest losses.

The biggest cuts to healthcare proposed so far are to the Medicaid program that provides health coverage for nearly 80 million people of all ages, including over 500,000 in West Virginia. To pay for more tax breaks for the rich and corporations, Republicans are proposing a $2.3 trillion cut to the joint federal-state program that funds healthcare for over half of U.S. children as well as long-term care for seniors and people with disabilities. Medicaid is the leading source of healthcare for low-income workers, leading payer of births and biggest provider of substance abuse and mental health treatment.

In addition to taking healthcare from millions of patients, cutting Medicaid also disrupts state budgets. Medicaid is the largest source of federal aid to the states and plays a critical role in supporting rural hospitals, disaster relief efforts and states with the fastest growing population of people 65 and over. As America confronts an unprecedented wave of aging people, demand and cost for Medicaid will only increase. The share of the population over 65 years old is projected to jump by almost half over the next 25 years, to over 80 million.

In West Virginia, Medicaid covers 25% of adults under 65 and 50% of our children!

Increased access to affordable healthcare through the ACA and Medicaid have benefited everyone and started to address longstanding racial, gender, and economic disparities in access to healthcare. Black, Latino Asian and Native American people who are the most likely to lack access to affordable coverage gained the most from investment in these programs. The uninsured rate among Black people fell by almost half–from 20.9% to 10.8%–between 2010 (when the ACA was enacted) and 2022, when the Biden reforms were in place. The Latino uninsured rate fell by almost as much, and the rate among Asian Americans fell by even more. Much of that progress is threatened by the healthcare cuts proposed by Trump and the Republicans to help pay for their tax breaks for the rich. And, because rich people are disproportionately white, trading health coverage for tax giveaways to wealthy households will doubly exacerbate the nation’s racial economic divide. The average white household is almost a quarter-million-dollars richer than the average Black family, and that gap has grown in recent years.

###

West Virginia Citizen Action has been advocating for tax fairness and universal health care access throughout its 50 years of advocacy for the citizens of West Virginia.