- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Updated July 14, 2009

Contact: Steve Wamhoff

(202) 299-1066 x33

Three Proposals to Pay for Health Care Reform without Hurting Struggling Families in West Virginia

Three Proposals Can Make the Tax Code Fairer and Help Finance Health Care Reform

Health care reform can save us all money in the long-run by bringing all Americans into the health insurance system and rooting out the inefficiencies that drive up costs. But to make that happen, Congress will first need to raise revenue to finance an overhauled health care system.

There are several ways to raise this revenue that would not hurt working families in West Virginia or in any other state. One is to apply a surcharge to the incomes of very wealthy taxpayers, as the House Ways and Means Committee has proposed. Another is to make the Medicare tax a more progressive tax that investors pay just like everyone else. A third option is to limit, as President Obama has proposed, the value of itemized deductions, which currently benefit rich families more than middle-income families.

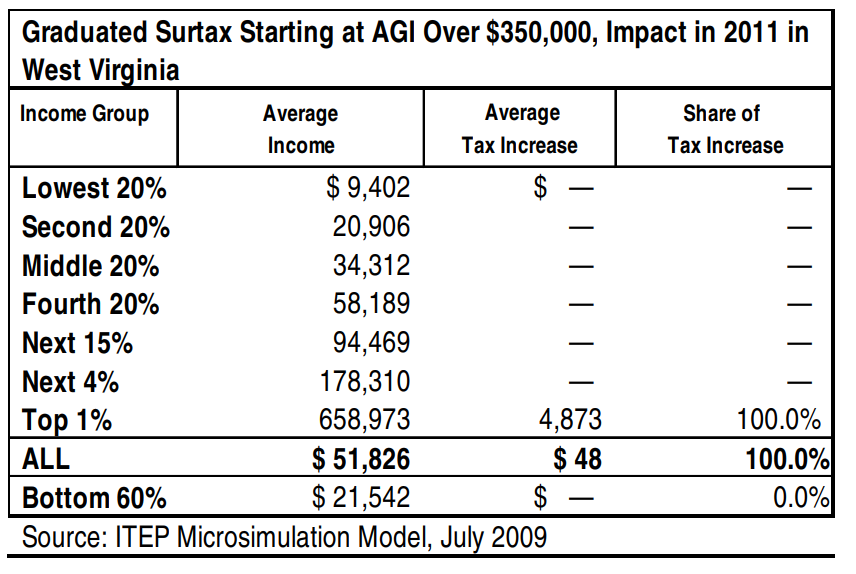

If Congress enacts the surcharge that the Ways and Means Committee has proposed, the richest

one percent of taxpayers in West Virginia would have an average tax increase of $4,873 in 2011 while middle-income taxpayers would have no tax increase at all.

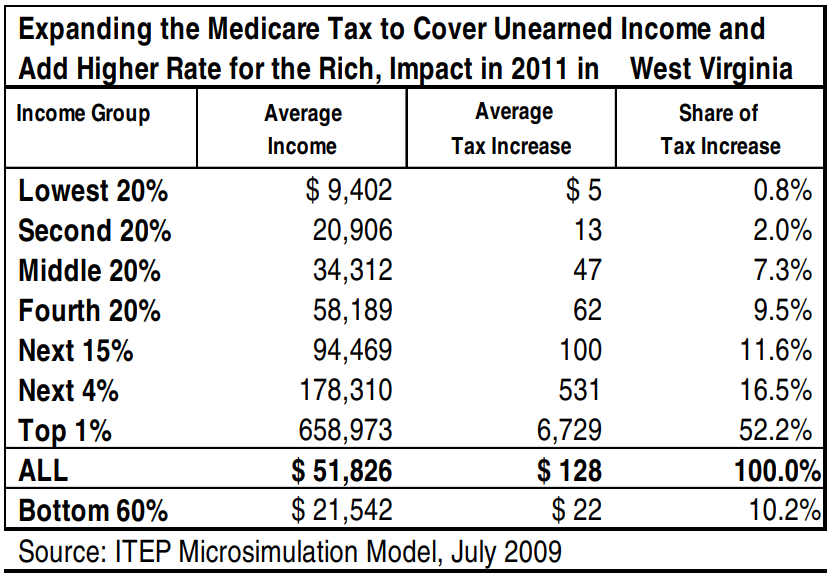

If Congress instead enacts the Medicare tax expansion described here, the richest one percent of taxpayers in West Virginia would have an average tax increase of $6,729 in 2011. The middle fifth of taxpayers would have an average tax increase of just $47.

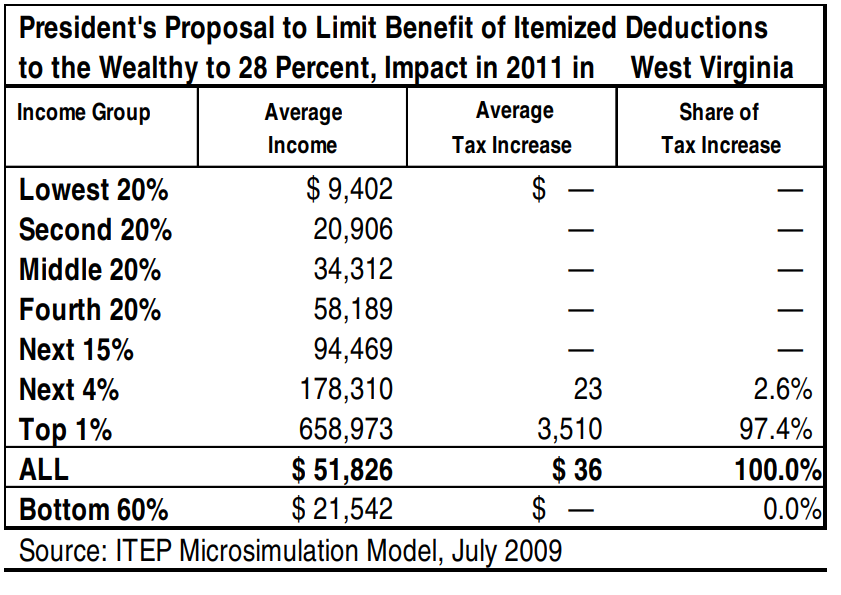

Finally, Congress could enact the President’s proposal to limit itemized deductions for the wealthy. The richest one percent of West Virginia taxpayers would have an average tax increase of $3,510 in 2011 while middle-income taxpayers would have no tax increase at all.

Proposal 1: A Graduated Surcharge on High-Income Taxpayers

Problem: President Bush and Congress Gave the Richest 1% of Taxpayers $700 Billion in Tax Cuts Over the 2001-2010 Period

The tax cuts enacted by President George W. Bush and Congress in 2001 and 2003, and subsequent legislation that extended them or made them take effect more quickly, went disproportionately to the wealthiest Americans. By the end of 2010, nearly half of these tax cuts will have been received by the richest five percent of Americans. The richest one percent alone will have received around $700 billion over the 2001-2010 period.

The Bush tax cuts expire at the end of 2010. For the most part, President Obama has not proposed to extend the Bush tax cuts for the very richest Americans. So in 2011, the richest one percent of taxpayers will face tax rates similar to (but not quite as high as) what existed at the end of the Clinton years.

But even the parts of the Bush tax cuts that will be allowed to expire at the end of 2010 represent lost revenue that could have been put to a more productive purpose. While some argue that the Bush tax cuts that went to the rich boosted our economy, that’s difficult to believe, given the sad evidence all around us.

Solution: A Graduated Surcharge that would Recoup a Fraction of the Bush Tax Cuts for the Rich

The graduated surcharge that the House Ways and Means Committee has proposed to finance health care reform would require the richest one percent to give back some, but not all, of the tax cuts they received over the 2001-2010 period.

The surcharge would have three brackets and would not affect married taxpayers unless their adjusted gross income (AGI) is above $350,000 (or $280,000 for single taxpayers). The surcharge rate would be one percent of AGI above this level, 2 percent of AGI above $500,000 (or $400,000 for singles) and 3 percent for AGI above $1 million (or $800,000 for singles).

If some level of additional savings in the health care system is not achieved in future years, this would “trigger” in 2013 an increase in the three rates to 2 percent, 3 percent, and 5 percent.

How Much Revenue would This Raise to Pay for Health Care and Who would Pay It?

The Ways and Means Committee estimates that the surcharge, which would almost entirely be paid by the richest one percent of taxpayers, would raise around $540 billion to $550 billion over ten years. This is confirmed by our calculations. This amount is less than the $700 billion that the richest one percent received from the Bush tax cuts over ten years.

Only 0.5 percent of West Virginia taxpayers would pay the proposed surcharge. As a result, about 100 percent of the resulting tax increase for West Virginia taxpayers would be paid by the richest one percent of the state’s taxpayers. Low- and middle-income taxpayers would, of course, not be affected at all.

Proposal 2: Make the Medicare Tax Fairer

Problem: We Have a Tax to Fund Health (the Medicare Tax) But Paris Hilton Is Exempt!

The Medicare payroll tax is the one important tax we already have that is dedicated to funding health care, but it completely exempts wealthy investors whose income takes the form of capital gains, stock dividends, and interest. Someone who does not have to work because she owns a lot of stocks or other assets and receives capital gains, dividends and interest currently pays no Medicare tax whatsoever.

The Medicare payroll tax is levied at a flat rate of 2.9 percent on all wages and salaries. Technically, half is paid by the employee and half is paid by the employer (but most economists think that the employee ultimately pays the employer portion as well through reduced wages).

Solution: Make the Medicare Tax a More Progressive Tax that Investors Pay Just Like Us

The Medicare tax can be improved with a few simple steps that have been formulated by Citizens for Tax Justice (CTJ) and endorsed by Health Care for America Now (HCAN). First, the individual portion of the Medicare tax (the 1.45 percent tax currently paid by employees) can be extended to cover unearned income like capital gains, stock dividends and other types of investment income, in addition to earnings.

Second, the individual portion of the Medicare tax (which would now cover both earnings and investment income) can be made progressive by introducing a higher rate of 2.5 percent that applies to taxpayers with income above $200,000 (or $250,000 for married couples). The employer portion of the Medicare tax would not be changed.

Third, to prevent a tax increase on moderate-income seniors, the expanded Medicare tax can exempt the first $50,000 of investment income for seniors (or $100,000 for married seniors).

How Much Revenue would This Raise to Pay for Health Care and Who would Pay It?

The proposal outlined here would raise $40.5 billion in revenue in 2011 and around $500 billion over a decade, without significantly burdening families that are currently struggling to obtain health care and other necessities.

If Congress enacted this proposal, most Americans would either see no tax increase at all or would see a tax increase of less than $100 a year. That’s because the proposal mainly targets unearned income (investment income), and the vast majority of investment income is received by the richest Americans.

As a result, about 52 percent of the resulting tax increase for West Virginia taxpayers would be paid by the richest one percent of the state’s taxpayers. About 69 percent would be paid by the richest five percent of the state’s taxpayers.

This proposal would also have little impact on seniors. Most Social Security benefits are already exempt from taxes, and this proposal would not change that. In addition, the exclusion for investment income for seniors ($50,000 for singles and $100,000 for married couples) would be more than adequate to shield the vast majority of seniors from a tax increase.

Proposal 3: Limit Itemized Deductions for Rich Families

Problem: Itemized Deductions Subsidize Activities at Higher Rates for High-Income People

Itemized deductions provide subsidies for certain activities (like buying a home or giving to charity) through the tax system. But they unfairly subsidize these activities at higher rates for wealthy families than they do for middle-income families.

People filing their federal income taxes are allowed deductions to lower their taxable income. They can either take a “standard deduction” or choose to “itemize” their deductions. Most people take the standard deduction, but well-off families typically itemize.

The income tax allows you to take an itemized deduction for interest you paid during the year on a

home mortgage, for charitable donations you made during the year, for state and local taxes you’ve paid, and for several other expenses.

The problem is that itemized deductions subsidize certain activities at a higher rate for high-income taxpayers. For example, the itemized deduction for home mortgage interest is supposed to encourage home ownership, but it does so in an outrageously unfair manner. Someone rich enough to be in the 39.6 percent income tax bracket will save almost 40 cents for each dollar they spend on mortgage interest.

A middle-income family might be in the 15 percent tax bracket. This family will save only 15 cents for each dollar they spend on mortgage interest.

If a member of Congress proposed a program to encourage home ownership through direct subsidies, with larger subsidies going to rich families than middle-income families, we would say that’s absurd. But that’s exactly how the itemized deductions work.

Solution: President Obama Would Limit Tax Savings to 28% of Itemized Deductions

The President would reduce, but not eliminate, this disparity by limiting the savings for each dollar of deductions to 28 cents. So someone in the 39.6 percent tax bracket would save 28 cents (instead of nearly 40 cents) for each dollar of itemized deductions. That’s still more than the family in the 15 percent bracket would save, but the difference would be reduced.

How Much Revenue would This Raise to Pay for Health Care and Who would Pay It?

The President’s proposal to limit the benefits of itemized deductions for high-income people would raise over $20 billion in 2011 and over $260 billion over ten years, without impacting the vast majority of Americans at all.

Only 0.6 percent of West Virginia taxpayers would be impacted in any way. As a result, about 97 percent of the resulting tax increase for West Virginia taxpayers would be paid by the richest one percent of the state’s taxpayers. About 100 percent would be paid by the richest five percent of the state’s taxpayers.

Misinformation about the Impact on Charities

Some lawmakers have expressed concern that this proposal would hurt non-profits because it would reduce the tax subsidy for charitable donations by wealthy taxpayers. But a recent report from the Center on Budget and Policy Priorities concludes that this proposal would only reduce charitable giving by around 1.9 percent.

That’s partly because only a small group of wealthy taxpayers are affected, and they only account for a fraction of the total charitable giving (about 17 percent) in the United States. Using previous studies on the way tax rates impact charitable giving, they estimate that this fraction of charitable giving will be reduced somewhat, but the overall impact on donations will be a reduction of only 1.9 percent.

The report also points out that non-profits could gain enormously if Congress uses this proposal to fund reform of the health care system, making it easier for non-profits and other entities to make sure their employees have adequate coverage.

DOWNLOAD PDF BELOW: