- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Under McCain Health Plan 99,125 People in West Virginia Would Lose Employer Sponsored Health Coverage A state-by-state analysis

by Josh Bivens and Elise Gould

Recently a team of prominent health economists estimated that 20 million people nationwide would lose employer sponsored insurance if the health care plan proposed by Senator John McCain were to become law (Buchmueller et al. 2008). This paper extends their analysis (published in the journal Health Affairs) by estimating the loss of employer sponsored insurance in each state. Because the centerpiece of the McCain plan would impose taxes on health insurance benefits—which are now untaxed—employers would be less likely to offer them.

At the state level we find that the state of West Virginia would see 99,125 people lose employer-sponsored health insurance under the McCain plan, and virtually all of these people would be forced to buy health insurance in the expensive and chaotic private insurance market. This means that 10.4% of people in West Virginia who currently have employer-sponsored health insurance.

Nationally, we are able to replicate the Buchmueller et al. (2008) results, finding that between 11 and 27 million U.S. residents would lose employer-sponsored insurance if the current tax exclusion were removed. The wide range of findings in both this report and Buchmueller et al. (2008) is a result of a wide range of estimates in the research literature regarding how responsive an employer’s decision to offer health insurance is to its after-tax price. The simple average of all of our estimates finds that over 19 million people would lose employer-sponsored coverage if the tax exclusion were removed, which is consistent with the Buchmueller results.

At the state level we find extensive losses of employer coverage across-the-board, unsurprising given the high national numbers. Losses range from a high of 15.5% in New York, Rhode Island, and Vermont to a low of 7.8% in Texas and Tennessee. These losses hit states particularly hard with high tax rates and/or high shares of employment in smaller firms. All in all, this proposed change would radically increase the already rapid unraveling of the employer-sponsored insurance system, which has seen a 5.4% decline in the share of those under 65 covered by such insurance since 2000.

Background on the employer exclusion

The current tax exclusion for premiums for employer-sponsored insurance allows employers to offer their employees either direct compensation in the form of health insurance premiums that are not taxed, and the opportunity to pay for premiums themselves with pre-tax (both payroll and

income tax) dollars.

This exclusion has attracted policy makers’ attention for a number of reasons. First, it is expensive, costing the federal government over $200 billion in foregone taxes in 2007. Second, it is regressive, with most benefits going to workers who are offered employer-sponsored insurance and who face high marginal tax rates, both of which indicate workers nearer the top of the earnings distribution.

These reasons (among others) explain why many recent health proposals have involved either reducing or outright eliminating the tax exclusion. While many of these other proposals have focused only on the income tax exclusion, it is not clear that the final McCain proposal will maintain the current exclusion for payroll taxes. Revenue estimates from the McCain campaign suggest

that the proposal will indeed end the payroll tax exclusion (Kvaal et al. 2008), but some independent assessments of the McCain proposal have only assumed an end to the income tax exclusion (Burman et al. 2008; Buchmueller et al. 2008). This paper also focuses only on the income tax exclusion. It should be noted that our estimates of employer-sponsored insurance loss would be substantially higher (by roughly a third) if in fact the payroll exclusion were also eliminated.

The current tax exclusion is a linchpin of the employer based health insurance system in the United States. While this system is far from perfect, it does pool and spread risk, and it is how 165 million U.S. residents under the age of 65 receive health insurance. Kicking away the

foundations of this system should only be done if there is a well-crafted alternative.

Summary of research methodology

Employers provide health insurance as a fringe benefit to attract employees in competitive labor markets. The current tax exclusion provides an implicit subsidy for employers’ compensation provided in the form of premiums. Removing this subsidy therefore reduces the incentive for employers to provide compensation in the form of premiums rather than cash.

Providing health insurance as compensation generally imposes some fixed costs on firms—for example, hiring a benefits manager to keep track of health care coverage. Also, high and volatile rates of inflation for health insurance premiums make it hard for employers to promise both a given level of health insurance coverage and also a target level of growth in cash compensation without exposing themselves to big risks from rapid premium growth year-to-year. Given these two considerations (among others), some firms (especially small firms that will find the administrative costs especially burdensome) may choose to provide insurance only if the implicit subsidy of the tax exclusion remains in place.

Research has verified that employers’ decision to offer insurance is indeed sensitive to the “tax price” of insurance, where the tax price is defined as how many after-tax dollars are needed to purchase one dollar’s worth of insurance premiums. Given the employer exclusion, the tax price of insurance is well under $1. The research shows that as the tax price of insurance rises, employers are less likely to offer insurance. This paper uses the quantitative findings on how responsive employer offer rates are to the changing tax price of insurance to get state-level estimates of how employer offers would change if the tax exclusion were eliminated. We discuss this literature and the value of these parameters at more length in the technical appendix.

Using marginal tax rates (which differ by state) and employer responsiveness to changing tax prices (which differs by firm size), we obtain state-level estimates of the number of people who would lose employer-sponsored insurance if the current income tax exclusion were removed.

Other parts of the broader McCain health proposal could also affect employer-sponsored insurance. For example, the addition of a tax credit for purchase of individual insurance coverage may induce younger and healthier employees to opt out of employer plans, which and less healthy, likely increasing premium rates and administrative costs.

Discussion of findings

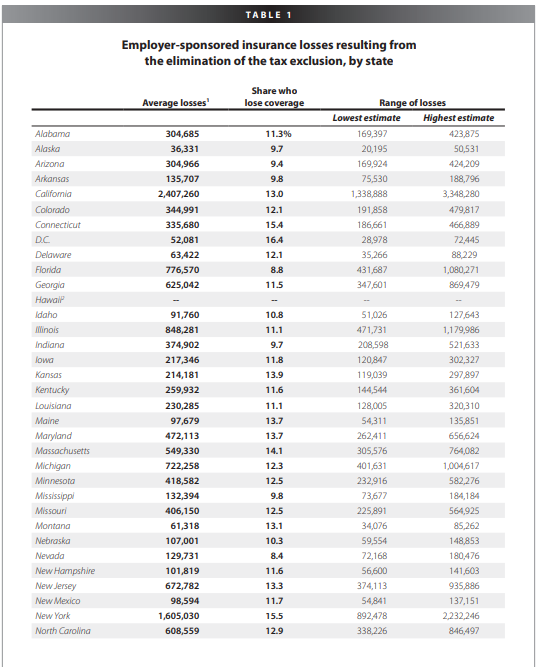

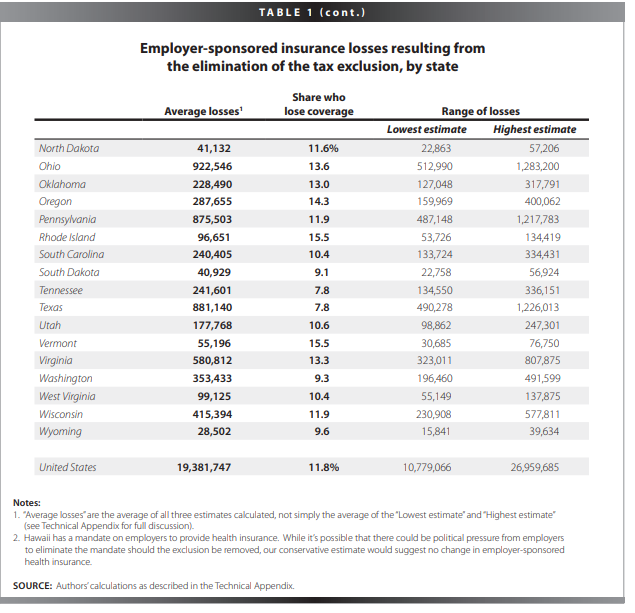

The results shown in Table 1 illustrate the range of possible losses in employer coverage by state. It also averages the range of results for each state, both in absolute coverage losses and expressed as a share of those currently covered by employer-sponsored insurance.

The absolute numbers on employer coverage loss are highly correlated with state population for obvious reasons: California leads the list in terms of absolute numbers of employer insurance loss, with an average estimate of 2.4 million. New York, Ohio, Texas, Pennsylvania, Illinois, Florida, Michigan, New Jersey, Georgia, North Carolina, Virginia, and Massachusetts also experience losses in excess of a half million.

By percentage losses, the biggest losers map closely to those states with the highest tax rates (e.g., Vermont, Rhode Island, Washington D.C., and New York). Every state, however, experiences an average loss in coverage of at least 7.8%.

It should be noted that our measure of employer sponsored insurance loss does not automatically translate into a rise in uninsurance—those losing employer coverage may buy coverage on the individual market, receive coverage through a spouse, or qualify for public insurance (Medicaid or State Children’s Health Insurance Program, for example). That said, it seems clear that having chosen employer-sponsored coverage in the first place over these competing alternatives, a loss of employer coverage would indeed be welfare-damaging. This intuition is firmly backed by research

documenting the failure of the most obvious specific source of alternative coverage—the non-group market—to provide decent insurance choices (or any choices at all), especially to the sickest insurance-seekers.

A large share of those losing employer coverage will have no choice (absent being uninsured) other than to seek coverage in the individual market. As numerous policy analysts have pointed out, however, individuals in the current non-group insurance market do not have the protection of being pooled together in large plans and are subject to the whims of private insurers.

As a result, this individual market is characterized by poor information about policies, discriminatory pricing, coverage exclusions, refusal to cover pre-existing conditions, and denials of policy renewal (CAPAF 2008; Buchmueller et al. 2008; Families USA 2008). Even worse, other planks of the McCain plan actually call for removing many of the (already insufficient) consumer protections that currently exist.

Conclusion

An estimated 165 million U.S. residents under the age of 65 currently receive insurance coverage through their employer. A linchpin of this system is the tax exclusion that allows premiums purchased by employer-based plans to be paid tax free. The centerpiece of John McCain’s plan for

health care reform would end this exclusion. This change would cost somewhere between 11 and 27 million people their employer coverage nationwide. Using a range of estimates of employer response identified in the academic literature, we estimate a range of state-by-state losses in

employer-sponsored coverage that could result from removal of the tax exclusion.

Again, it should be noted that while many of these workers and their dependents may be able to find insurance through another source, many may not be able to do so. Furthermore, loss of employer-sponsored coverage, as noted previously, will almost surely lead to a welfare loss even for those affected workers who manage to purchase a plan on the individual market.

Technical Appendix

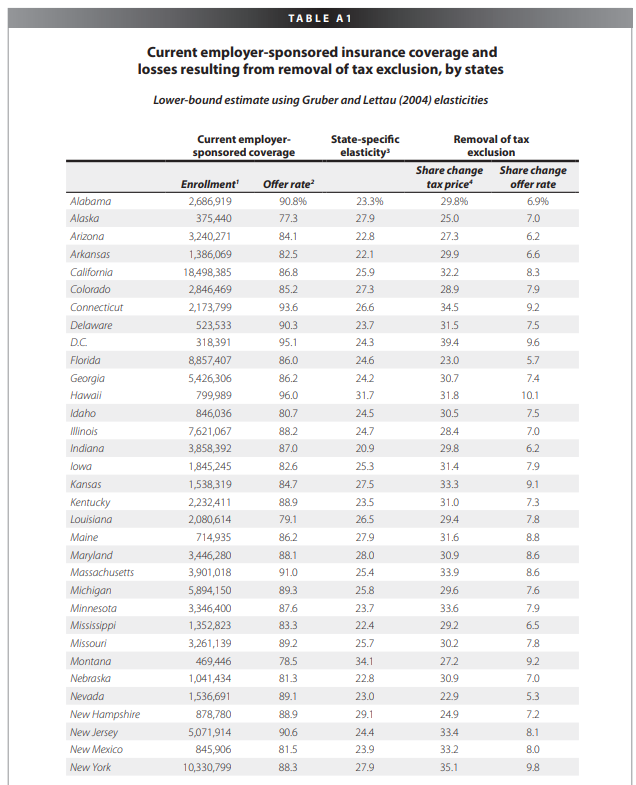

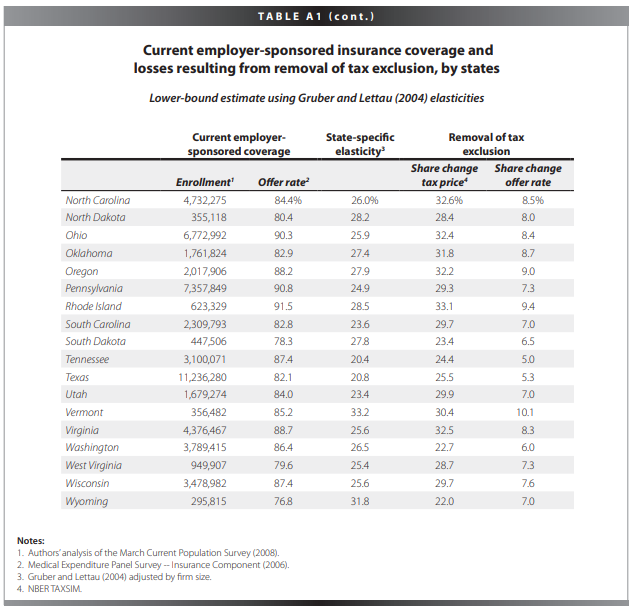

The methodology of this study is straight-forward (see Table A1). We use “off-the-shelf ” measures of employers’ elasticity of offer and combine these with (mostly) off-the-shelf measures of state averages of the tax price of insurance.

The elasticity of offer is simply a measure of how responsive employers’ decision to offer insurance to their employees is to its “tax-price.” The tax price of insurance is a measure of how many after-tax dollars are needed to purchase one dollar’s worth of health insurance premiums.

Given that health insurance premiums in employer sponsored plans are not subject to payroll or federal income tax, the tax price of health insurance today is well under $1. This allows employers to offer a dollar’s worth of health insurance premiums for less than they could offer a dollar’s worth of after-tax cash compensation, hence providing a strong incentive for employers to offer compensation to their employees in the form of health insurance.

As noted in the body of the paper, since providing insurance often imposes a cost on firms and makes year-toyear planning of compensation offers difficult, employers may stop offering insurance in the place of cash compensation if the tax-price of insurance rises.

Elasticity of offer

The empirical research backs up this intuition—increases in the tax-price of insurance are indeed correlated in the real world with changing offer decisions by employers. Three of the highest quality academic studies addressing this issue are Finkelstein (2004), Gruber and Lettau (2004), and Beeson-Royalty (2000). The elasticities of offer identified in these studies range from -0.25 to -0.70.

What this means intuitively is that each 1% increase (decrease) in the tax price of health insurance will lead to a decrease (increase) in the probability that employers will offer insurance ranging from 0.25% to 0.7%. Both Finkelstein (2004) and Gruber and Lettau (2004) find that the elasticity of offer varies negatively with firm-size, meaning that small firms respond much more strongly to a change in the tax price of insurance than do medium or larger-sized firms.

This paper uses each of these three estimates, as they are generally considered among the highest quality in the field. When we present average results by state, we average the findings using each of these three elasticities.

The lowest estimates come from Gruber and Lettau (2004), who base them on an estimation of relatively small changes in tax prices—essentially, differences in the tax-price across states and earnings levels. As such, using them to project a very large change in tax prices resulting

from a complete removal of the tax exclusion for health insurance premiums could well understate the fallout of this policy, as they note themselves. Using the Gruber and Lettau (2004) estimates and applying them to our state-by-state sample indicates that 11 million people would lose employer coverage.

Finkelstein (2004) examines a very large change in tax policy—a 60% reduction in tax subsidies to employer provided supplementary health insurance in the Canadian province of Quebec. The size of this change is more comparable to the McCain plan to remove the income tax exclusion. Her preferred elasticity is almost twice as large as that found by Gruber and Lettau (2004). While a better analogue to the magnitude of the tax price change examined in this paper, given that Finkelstein (2004) focuses on supplemental (not comprehensive) coverage in the context of the quite different Canadian insurance market, we choose not to rely exclusively on it. Using the Finkelstein estimates, we find that employee receipt of employer-sponsored coverage would fall by 20 million.

Royalty (2000) provides one of the larger estimates in the literature, well over twice as large as the Gruber and Lettau (2004) findings. Applying her estimate to our sample we find that 27 million Americans would lose employer coverage if the tax exclusion for premiums paid through employer-sponsored insurance were eliminated.

Constructing state-level estimates of employer coverage loss

In Table A1 we present an example of our methodology using the relevant firm-size elasticities identified by Gruber and Lettau (2004).

We first obtained the distribution of employees currently enrolled in employer-sponsored coverage by various firm-size categories in each state. We then constructed a weighted state-wide elasticity based on the state’s distribution of covered employees across firm-sizes. States with a greater share of current enrollees employed by smaller firms will, by construction, have a higher average

elasticity of offer and vice-versa.

Tax-price of insurance by state

Next, we obtained data on marginal tax rates by income type by state to construct a tax-price for insurance in each Current employer-sponsored insurance coverage and losses resulting from removal of tax exclusion, by states Lower-bound estimate using Gruber and Lettau (2004) elasticities state. To calculate this, we use the summary tables provided by the TAXSIM model constructed by the National Bureau of Economic Research (NBER) and the state-level reports on aggregate state income by type of income compiled by the Statistics of Income (SOI) division of the

Internal Revenue Service (IRS). We multiply the marginal tax rates by type of income from TAXSIM by the share of all state income earned in each respective class reported by the SOI. Then we sum

the contributions to get a single average marginal tax rate by state. Once we have this existing marginal tax rate by state, we can calculate the tax price of insurance, which, following Gruber and Lettau, is simply:

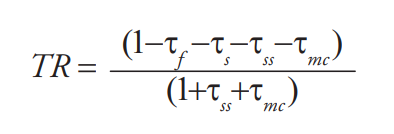

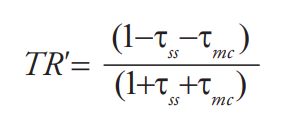

Where t specifies a given marginal tax rate, and the sub- scripts f, s, ss, and mc refer respectively to federal income taxes, state income taxes, Social Security payroll taxes, and Medicare payroll taxes. The elimination of the income tax exclusion (while maintaining the payroll tax exclusion) changes the tax price of insurance to:

Estimates of employer coverage loss

Given each state’s existing tax price for insurance, we can then calculate the percentage change in this tax price if the employer exclusion for health insurance premiums purchased through employer-sponsored insurance were eliminated.

As stated previously, McCain has yet to specify that his proposal retains the payroll tax exclusion. If his plan eliminated both the income and payroll tax exclusion, the tax price of insurance becomes $1. The change in health insurance price is even greater under this scenario, causing a larger employer response and greater losses in employer sponsored health insurance. This percentage change in the tax price for insurance is then multiplied by the state-level elasticity of offer (which, again, is a function of the share of enrollees in different firm-size categories). This yields the percentage change in the probability of offer. Multiplying this percentage change by the share of employees in each state currently offered employer-sponsored insurance gives us the change in offer rates for the state. This change was then multiplied by the total number of people in the state covered by employer-sponsored insurance to get the final numbers reported in Table 1.

DOWNLOAD PDF BELOW:

Read more about how WV CAG’s supports affordable healthcare through their work here.