- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

As a member of the Coalition for West Virginia Families, WV CAG is looking for ways to make our tax system less regressive. We support the Coalition’s recommendation that families making below poverty-level wages be exempted from paying state income tax and will work to introduce legislation accomplishing this objective.

On the other end of the scale, we must continually push for large mineral holdings to be assessed at fair market value in order to provide revenue for local schools and services. The repeal of the “Managed timber land tax credit” for large timber companies is a major priority of WV CAG.

161 posts found, showing 20 per page

Press Release Gary Zuckett December 20, 2022

ATF PRESS RELEASE: In Blocking Renewal Of Three Corporate Tax Breaks, Congress Is Poised To Win One For Tax Fairness

In a victory for tax fairness, Congress has rejected in the newly released omnibus spending package the renewal of three major tax breaks urgently sought by big corporations, which were part of the 2017 Trump-GOP tax law. Together they could have cost $600 billion in lost revenue over 10 years. More

Issues: Fair taxation, Inequality, Taxes

ATF PRESS RELEASE: In Blocking Renewal Of Three Corporate Tax Breaks, Congress Is Poised To Win One For Tax Fairness

In a victory for tax fairness, Congress has rejected in the newly released omnibus spending package the renewal of three major tax breaks urgently sought by big corporations, which were part of the 2017 Trump-GOP tax law. Together they could have cost $600 billion in lost revenue over 10 years. More

Issues: Fair taxation, Inequality, Taxes

Citizen Action Group Blog CAG November 14, 2022

Letter to Sen. Manchin & Capito: 17 WV orgs share strong support for prioritizing extension of the expanded Child Tax Credit and Earned Income Tax Credit as part of any year-end budget deal

17 organizations in WV have shared with our Senators their support for prioritizing the expanded Child and Earned Income Tax Credits. More

Issues: Budget Priorities, Economy, Fair taxation, Families

Letter to Sen. Manchin & Capito: 17 WV orgs share strong support for prioritizing extension of the expanded Child Tax Credit and Earned Income Tax Credit as part of any year-end budget deal

17 organizations in WV have shared with our Senators their support for prioritizing the expanded Child and Earned Income Tax Credits. More

Issues: Budget Priorities, Economy, Fair taxation, Families

Action Alert CAG October 25, 2022

Swingstein and Robin Benefit for WVCAG – Oct. 27, 5:30PM

Join us on Thursday, October 27th from 5:30-7:30PM for a Swingstein and Robin musical fundraiser for WVCAG at the Empty Glass! More

Issues: Budget Priorities, Democracy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Swingstein and Robin Benefit for WVCAG – Oct. 27, 5:30PM

Join us on Thursday, October 27th from 5:30-7:30PM for a Swingstein and Robin musical fundraiser for WVCAG at the Empty Glass! More

Issues: Budget Priorities, Democracy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Citizen Action Group Blog Julie Archer October 24, 2022

Much At Stake With Proposed Constitutional Amendments

In addition to the congressional, legislative, county and local elected offices that will appear on the ballot this November, voters must also consider four separate amendments to the state’s constitution. Here’s a refresher on what’s at stake with these proposed changes to the West Virginia Constitution. More

Issues: Budget Priorities, Elections, Fair Courts, Fair taxation, Taxes, Voting

Much At Stake With Proposed Constitutional Amendments

In addition to the congressional, legislative, county and local elected offices that will appear on the ballot this November, voters must also consider four separate amendments to the state’s constitution. Here’s a refresher on what’s at stake with these proposed changes to the West Virginia Constitution. More

Issues: Budget Priorities, Elections, Fair Courts, Fair taxation, Taxes, Voting

Action Alert CAG August 24, 2022

Tele-Town Hall on the Inflation Reduction Act & Tax Fairness

Join West Virginians United for a Tele-Town Hall regarding the Inflation Reduction Act & Tax Fairness on Thursday, August 25th at 6pm! More

Issues: Fair taxation, Taxes

Tele-Town Hall on the Inflation Reduction Act & Tax Fairness

Join West Virginians United for a Tele-Town Hall regarding the Inflation Reduction Act & Tax Fairness on Thursday, August 25th at 6pm! More

Issues: Fair taxation, Taxes

Action Alert CAG August 22, 2022

Deep Canvass Institute: September Training Series

For over a decade, deep canvassers have been changing hearts and minds around race, immigration, public safety, marriage equality, the environment and more. We will dive into what is deep canvassing, what it has achieved and training, demonstrate script structure and the deep canvass skill of telling your stories! More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Deep Canvass Institute: September Training Series

For over a decade, deep canvassers have been changing hearts and minds around race, immigration, public safety, marriage equality, the environment and more. We will dive into what is deep canvassing, what it has achieved and training, demonstrate script structure and the deep canvass skill of telling your stories! More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Citizen Action Group Blog August 5, 2022

HIGHLIGHTS OF THE $3.5 TRILLION SENATE BUDGET RESOLUTION

Passing President Biden’s Build Back Better plan will provide an opportunity to make historic investments in working families, jobs, the environment, affordable health care, education and so much more. It will also help unrig our tax code and economy to ensure millionaires, billionaires and corporations begin to pay their fair share. More

Issues: Fair taxation

HIGHLIGHTS OF THE $3.5 TRILLION SENATE BUDGET RESOLUTION

Passing President Biden’s Build Back Better plan will provide an opportunity to make historic investments in working families, jobs, the environment, affordable health care, education and so much more. It will also help unrig our tax code and economy to ensure millionaires, billionaires and corporations begin to pay their fair share. More

Issues: Fair taxation

Action Alert Eve Marcum-Atkinson July 22, 2022

TAKE ACTION: Tell your Delegate(s) & Senators to reject this plan to give tax cuts to the wealthy at the cost of state programs and services!

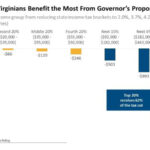

At a cost of $254 million per year, over 5% of our state budget, the governor’s tax plan overwhelmingly benefits with wealthy with 62% of the tax cuts going to the top 20% of households. More

Issues: Budget Priorities, Fair taxation

TAKE ACTION: Tell your Delegate(s) & Senators to reject this plan to give tax cuts to the wealthy at the cost of state programs and services!

At a cost of $254 million per year, over 5% of our state budget, the governor’s tax plan overwhelmingly benefits with wealthy with 62% of the tax cuts going to the top 20% of households. More

Issues: Budget Priorities, Fair taxation

Newsletter article Gary Zuckett July 21, 2022

Oppose Tax Cuts for the Rich

On Wednesday morning, Governor Justice announced a special legislative session beginning at noon on Monday to begin phasing out the state income tax. Don’t be fooled, this is the first salvo in eventually eliminating the personal income tax completely. More

Issues: Budget Priorities, Fair taxation

Oppose Tax Cuts for the Rich

On Wednesday morning, Governor Justice announced a special legislative session beginning at noon on Monday to begin phasing out the state income tax. Don’t be fooled, this is the first salvo in eventually eliminating the personal income tax completely. More

Issues: Budget Priorities, Fair taxation

Newsletter article CAG July 21, 2022

Billionaires are Buying Federal Elections, Putting Democracy at Risk

On July 13th, WV Citizen Action Group co-released a new report in collaboration with Americans for Tax Fairness showing that America’s billionaires are pumping tens of millions of dollars into the 2022 midterm elections, mostly backing Republican candidates for Congress who will cut taxes for the ultra-rich and the corporations they own. More

Issues: Democracy, Fair taxation

Billionaires are Buying Federal Elections, Putting Democracy at Risk

On July 13th, WV Citizen Action Group co-released a new report in collaboration with Americans for Tax Fairness showing that America’s billionaires are pumping tens of millions of dollars into the 2022 midterm elections, mostly backing Republican candidates for Congress who will cut taxes for the ultra-rich and the corporations they own. More

Issues: Democracy, Fair taxation

Newsletter CAG July 21, 2022

Capital Eye Vol. 15 No. 13: A Record Summer

July has seen record temperatures, deadly flooding, lost bodily autonomy, reduced EPA authority to control emissions, and more. WVCAG has been head down & nose-to-the-grind-stone doing what we can to help. More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Capital Eye Vol. 15 No. 13: A Record Summer

July has seen record temperatures, deadly flooding, lost bodily autonomy, reduced EPA authority to control emissions, and more. WVCAG has been head down & nose-to-the-grind-stone doing what we can to help. More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Newsletter article CAG July 21, 2022

Senator Manchin – Don’t Gamble with Our Future

Just days after Sen Manchin announced he was ‘postponing’ his support for the reconciliation bill being negotiated in the US Senate and delaying investments necessary to address the climate crisis, WV CAG and partners organized a rally outside his Charleston office calling on him to put #PeopleOverProfits and not to gamble with our future! More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Environment, Fair taxation, Families

Senator Manchin – Don’t Gamble with Our Future

Just days after Sen Manchin announced he was ‘postponing’ his support for the reconciliation bill being negotiated in the US Senate and delaying investments necessary to address the climate crisis, WV CAG and partners organized a rally outside his Charleston office calling on him to put #PeopleOverProfits and not to gamble with our future! More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Environment, Fair taxation, Families

Press Release Eve Marcum-Atkinson July 16, 2022

MEDIA ADVISORY: Rally to be held outside Senator Manchin’s Charleston office on Monday

This Monday, July 18th, at 5PM, WV Citizen Action and others will host a public rally outside of Senator Manchin’s office at These WV groups and citizens are inviting the press to attend, and everyone who is concerned about passing a robust climate change policy funded by fair taxation. More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Environment, Fair taxation, Families

MEDIA ADVISORY: Rally to be held outside Senator Manchin’s Charleston office on Monday

This Monday, July 18th, at 5PM, WV Citizen Action and others will host a public rally outside of Senator Manchin’s office at These WV groups and citizens are inviting the press to attend, and everyone who is concerned about passing a robust climate change policy funded by fair taxation. More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Environment, Fair taxation, Families

Action Alert CAG July 13, 2022

Launch Event for the Excessive Wealth Disorder Institute and Tax the Ultra-Rich Now (TURN) Campaign

On Thursday, July 14th, join us for the launch of the TURN campaign and the Excessive Wealth Disorder Institute. We’ll hear from experts and activists alike about why now is the time to tax the ultra-rich, and how you can get involved. More

Issues: Budget Priorities, Democracy, Economy, Fair taxation, Families, Workers

Launch Event for the Excessive Wealth Disorder Institute and Tax the Ultra-Rich Now (TURN) Campaign

On Thursday, July 14th, join us for the launch of the TURN campaign and the Excessive Wealth Disorder Institute. We’ll hear from experts and activists alike about why now is the time to tax the ultra-rich, and how you can get involved. More

Issues: Budget Priorities, Democracy, Economy, Fair taxation, Families, Workers

Press Release Gary Zuckett July 13, 2022

PRESS RELEASE: 147 National, State, And Local Organizations Support The Tax Filing Simplification Act

As groups dedicated to promoting the well-being of children and families and advancing social, racial, gender, disability, worker and economic justice, we write to express our strong support for the Tax Filing Simplification Act (TFSA) of 2022. More

Issues: Fair taxation, Families

PRESS RELEASE: 147 National, State, And Local Organizations Support The Tax Filing Simplification Act

As groups dedicated to promoting the well-being of children and families and advancing social, racial, gender, disability, worker and economic justice, we write to express our strong support for the Tax Filing Simplification Act (TFSA) of 2022. More

Issues: Fair taxation, Families

Press Release Gary Zuckett July 13, 2022

PRESS RELEASE: New Report Shows Growing Trend: Billionaires Buying Federal Elections, Democracy Is At Risk

America’s Wealthiest Pump Millions Into 2022 Campaigns, Mostly to Republicans Who Will Cut Their Taxes and Supported Trump’s January 6th Insurrection More

Issues: Democracy, Fair taxation

PRESS RELEASE: New Report Shows Growing Trend: Billionaires Buying Federal Elections, Democracy Is At Risk

America’s Wealthiest Pump Millions Into 2022 Campaigns, Mostly to Republicans Who Will Cut Their Taxes and Supported Trump’s January 6th Insurrection More

Issues: Democracy, Fair taxation

Action Alert CAG June 1, 2022

First Friday Happy Hour at WVCAG – 6/3/2022

Join us for this month's edition of our First Friday Happy Hour at the WVCAG office front porch. Please wear masks & use social distancing... More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

First Friday Happy Hour at WVCAG – 6/3/2022

Join us for this month's edition of our First Friday Happy Hour at the WVCAG office front porch. Please wear masks & use social distancing... More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Families, Healthcare, Workers

Action Alert May 25, 2022

Billionaire Taxation – Tele-Town Hall, May 26th at 6:30PM

Please join us for a tele-town hall on Billionaire Taxation, with featured speakers: Frank Clemente of Americans for Tax Fairness, WV State Delegate Mike Pushkin, and Lida Shepherd of WV Economic Justic Project. More

Issues: Economy, Fair taxation

Billionaire Taxation – Tele-Town Hall, May 26th at 6:30PM

Please join us for a tele-town hall on Billionaire Taxation, with featured speakers: Frank Clemente of Americans for Tax Fairness, WV State Delegate Mike Pushkin, and Lida Shepherd of WV Economic Justic Project. More

Issues: Economy, Fair taxation

Press Release CAG April 18, 2022

PRESS RELEASE – US Billionaires Doubled Wealth During Pandemic – Should Pay Fair Share of Taxes

ON THIS TAX DAY, WEST VIRGINIA’S WORKING FAMILIES ARE PAYING THEIR FAIR SHARE BUT AMERICA’S BILLIONAIRES ARE NOT! More

Issues: Budget Priorities, Economy, Fair taxation, Families, Healthcare, Workers

PRESS RELEASE – US Billionaires Doubled Wealth During Pandemic – Should Pay Fair Share of Taxes

ON THIS TAX DAY, WEST VIRGINIA’S WORKING FAMILIES ARE PAYING THEIR FAIR SHARE BUT AMERICA’S BILLIONAIRES ARE NOT! More

Issues: Budget Priorities, Economy, Fair taxation, Families, Healthcare, Workers

Action Alert CAG March 23, 2022

WVCBP: Post-session ‘Where are we now’ in terms of funding our future and supporting families?

Join WVCBP at noon on Wednesday, April 6 for a session debrief, for an analysis of what’s up with the budget, and how we can use interims meetings over the rest of this year to make the case for investments in programs we care about. More

Issues: Budget Priorities, Economy, Fair taxation, Families, Workers

WVCBP: Post-session ‘Where are we now’ in terms of funding our future and supporting families?

Join WVCBP at noon on Wednesday, April 6 for a session debrief, for an analysis of what’s up with the budget, and how we can use interims meetings over the rest of this year to make the case for investments in programs we care about. More

Issues: Budget Priorities, Economy, Fair taxation, Families, Workers