- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

As a member of the Coalition for West Virginia Families, WV CAG is looking for ways to make our tax system less regressive. We support the Coalition’s recommendation that families making below poverty-level wages be exempted from paying state income tax and will work to introduce legislation accomplishing this objective.

On the other end of the scale, we must continually push for large mineral holdings to be assessed at fair market value in order to provide revenue for local schools and services. The repeal of the “Managed timber land tax credit” for large timber companies is a major priority of WV CAG.

161 posts found, showing 20 per page

Citizen Action Group Blog May 15, 2018

Congress Wants to Cut Food Stamps After Giving 1% a Big Tax Break

The partisan Republican farm bill isn’t fooling anyone: punishing kids, seniors, people with disabilities and low wage workers won’t get people back to work or help the economy just like tax breaks for the rich haven’t created jobs or helped the middle class. Instead, the current Republican SNAP proposals are designed to shrink the food stamp program so that Republicans can free up more money to pay for their massive tax giveaway. More

Issues: Budget Priorities, Fair taxation, Inequality, Kids and families, Poverty, SNAP

Congress Wants to Cut Food Stamps After Giving 1% a Big Tax Break

The partisan Republican farm bill isn’t fooling anyone: punishing kids, seniors, people with disabilities and low wage workers won’t get people back to work or help the economy just like tax breaks for the rich haven’t created jobs or helped the middle class. Instead, the current Republican SNAP proposals are designed to shrink the food stamp program so that Republicans can free up more money to pay for their massive tax giveaway. More

Issues: Budget Priorities, Fair taxation, Inequality, Kids and families, Poverty, SNAP

Action Alert May 15, 2018

Tell Your Representative to Protect Food Access, Vote No on the Farm Bill

The House Republican Farm Bill (H.R. 2) cuts $20 billion from SNAP (Supplemental Nutrition Assistance Program) by creating new requirements, red tape, and bureaucratic hoops that will make it much harder to access critical benefits. Call your Representative today at 1-888-398-8702. Tell them to protect food access and vote NO on the Farm Bill that cuts food stamps for millions of Americans who can’t afford to eat. More

Issues: Budget Priorities, Fair taxation, Inequality, Kids and families, Poverty, SNAP

Tell Your Representative to Protect Food Access, Vote No on the Farm Bill

The House Republican Farm Bill (H.R. 2) cuts $20 billion from SNAP (Supplemental Nutrition Assistance Program) by creating new requirements, red tape, and bureaucratic hoops that will make it much harder to access critical benefits. Call your Representative today at 1-888-398-8702. Tell them to protect food access and vote NO on the Farm Bill that cuts food stamps for millions of Americans who can’t afford to eat. More

Issues: Budget Priorities, Fair taxation, Inequality, Kids and families, Poverty, SNAP

Newsletter CAG April 24, 2018

Capital Eye Vol. 11, No. 10 – Spring 2018 Edition

In this Capital Eye: 2018 Legislative Wrap-Up, Trump Tax Scam Continues War on Health Care, Power to the People: WV CAG's Awards Dinner & Fundraiser, In Memory of a Big Hearted Water Warrior, Election 2018 (Be Ready to Vote: Voter ID Law Now in Effect, Follow the Money, Constitutional Amendments on the Ballot in November), Energy Efficient West Virginia (EEWV) Updates (FirstEnergy Drops Bid to Sell Pleasants Power Plant & more) More

Issues: Civil Rights, Democracy, Energy, Fair taxation, Healthcare, Workers

Capital Eye Vol. 11, No. 10 – Spring 2018 Edition

In this Capital Eye: 2018 Legislative Wrap-Up, Trump Tax Scam Continues War on Health Care, Power to the People: WV CAG's Awards Dinner & Fundraiser, In Memory of a Big Hearted Water Warrior, Election 2018 (Be Ready to Vote: Voter ID Law Now in Effect, Follow the Money, Constitutional Amendments on the Ballot in November), Energy Efficient West Virginia (EEWV) Updates (FirstEnergy Drops Bid to Sell Pleasants Power Plant & more) More

Issues: Civil Rights, Democracy, Energy, Fair taxation, Healthcare, Workers

Press Release April 17, 2018

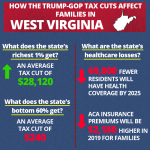

New ‘Tax Day’ Study Reports on How Tax Law Enriches Corporations, Wealthy While Putting Health Care, Public Services at Risk

Today, WV Citizen Action released a new report by Americans for Tax Fairness and Health Care for America Now detailing the affects of the tax cut package on families in West Virginia and compares that with the tax benefits that health insurance companies and prescription drug manufacturers receive under the same law. Read the full report and highlights here. More

Issues: Fair taxation, Healthcare, Inequality, Kids and families, Medicare, SNAP, Social security

New ‘Tax Day’ Study Reports on How Tax Law Enriches Corporations, Wealthy While Putting Health Care, Public Services at Risk

Today, WV Citizen Action released a new report by Americans for Tax Fairness and Health Care for America Now detailing the affects of the tax cut package on families in West Virginia and compares that with the tax benefits that health insurance companies and prescription drug manufacturers receive under the same law. Read the full report and highlights here. More

Issues: Fair taxation, Healthcare, Inequality, Kids and families, Medicare, SNAP, Social security

Action Alert January 29, 2018

Get On The Bus – Let’s Remind Congressional Republicans of OUR Priorities

Later this week (January 31 - February 2), Congressional Republican leaders will be meeting at Jim Justice's Greenbrier resort for their legislative retreat. This is where Congressional leaders will be setting their priorities for 2018. Together with hundreds of Americans coming from around the country, we will be gathering there to remind them of OUR priorities. We want a government that works for the common good - for all of us, not just a wealthy few. Please join us. On February 1, we'll be taking a bus from Charleston, leaving at 9am on Thursday, and returning that evening around 6pm. Click here for more details. More

Issues: Budget Priorities, Fair taxation, Healthcare, Inequality, Medicare, Poverty

Get On The Bus – Let’s Remind Congressional Republicans of OUR Priorities

Later this week (January 31 - February 2), Congressional Republican leaders will be meeting at Jim Justice's Greenbrier resort for their legislative retreat. This is where Congressional leaders will be setting their priorities for 2018. Together with hundreds of Americans coming from around the country, we will be gathering there to remind them of OUR priorities. We want a government that works for the common good - for all of us, not just a wealthy few. Please join us. On February 1, we'll be taking a bus from Charleston, leaving at 9am on Thursday, and returning that evening around 6pm. Click here for more details. More

Issues: Budget Priorities, Fair taxation, Healthcare, Inequality, Medicare, Poverty

Action Alert December 18, 2017

Last Chance to Stop the Tax Scam

Donald Trump and Republicans in Washington are calling their tax bill a Christmas gift to the middle-class. We can't let members of Congress pass their terrible tax scam while they lie to the American people about the real-life consequences of this bill. Call your U.S. Representative and Senator Capito today and demand they reject a tax plan that hands trillions of dollars in tax breaks to the rich and powerful on the backs of working families, older Americans, and people with disabilities. More

Issues: Budget Priorities, Fair taxation, Healthcare, Inequality, Kids and families, Medicare

Last Chance to Stop the Tax Scam

Donald Trump and Republicans in Washington are calling their tax bill a Christmas gift to the middle-class. We can't let members of Congress pass their terrible tax scam while they lie to the American people about the real-life consequences of this bill. Call your U.S. Representative and Senator Capito today and demand they reject a tax plan that hands trillions of dollars in tax breaks to the rich and powerful on the backs of working families, older Americans, and people with disabilities. More

Issues: Budget Priorities, Fair taxation, Healthcare, Inequality, Kids and families, Medicare

Newsletter CAG November 25, 2017

Capital Eye: Fall 2017 Vol. 10 No. 12

We may not have been able to stop Trump from taking office, but we can and will continue to fight back against his disastrous policies and executive orders. With your support, WV Citizen Action is ready to keep the pressure on Trump, as well as federal and state lawmakers supporting his agenda. Click here for actions you can take now to push back against efforts to repeal the Clean Power Plan, and giving massive, unnecessary tax cuts to billionaires that will force cuts in health care, education and other vital programs. Our fight isn’t just in Washington. We've also included actions you can take to protect West Virginia consumers and energy efficiency programs at the PSC. More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Healthcare

Capital Eye: Fall 2017 Vol. 10 No. 12

We may not have been able to stop Trump from taking office, but we can and will continue to fight back against his disastrous policies and executive orders. With your support, WV Citizen Action is ready to keep the pressure on Trump, as well as federal and state lawmakers supporting his agenda. Click here for actions you can take now to push back against efforts to repeal the Clean Power Plan, and giving massive, unnecessary tax cuts to billionaires that will force cuts in health care, education and other vital programs. Our fight isn’t just in Washington. We've also included actions you can take to protect West Virginia consumers and energy efficiency programs at the PSC. More

Issues: Civil Rights, Democracy, Economy, Energy, Environment, Fair taxation, Healthcare

Action Alert November 20, 2017

Tell Senators Capito & Manchin to Say “No Thanks!” to GOP Tax Plan

This week, members of Congress are back home for Thanksgiving recess. When they return to Washington next week, the Senate will vote on a tax plan that would balloon the country’s deficit by giving away massive tax cuts to wealthy individuals and corporations, while giving families, students, people in recovery, and small business owners even less to be thankful for in the coming years. We must send a strong message to Senators Shelley Moore Capito and Joe Manchin and tell them to say “No thanks!” to the GOP tax plan. More

Issues: Budget Priorities, Fair taxation, Healthcare, Inequality, Kids and families, Medicare

Tell Senators Capito & Manchin to Say “No Thanks!” to GOP Tax Plan

This week, members of Congress are back home for Thanksgiving recess. When they return to Washington next week, the Senate will vote on a tax plan that would balloon the country’s deficit by giving away massive tax cuts to wealthy individuals and corporations, while giving families, students, people in recovery, and small business owners even less to be thankful for in the coming years. We must send a strong message to Senators Shelley Moore Capito and Joe Manchin and tell them to say “No thanks!” to the GOP tax plan. More

Issues: Budget Priorities, Fair taxation, Healthcare, Inequality, Kids and families, Medicare

Press Release CAG October 20, 2017

Senator Capito Votes for Senate Budget Resolution That Puts Health Care for West Virginia Families at Risk

The budget resolution sets up blueprint for tax cuts that mostly benefit wealthy households while cutting health care and education for everyone else. Senator Capito voted for the Resolution that could put Medicaid for 438,000 West Virginians at risk as well as Medicare for 416,000 seniors and people with disabilities. Time and time again, Senator Capito has shown that, despite what she says, her priorities are taking care of the wealthy and big business, not her constituents. More

Issues: Budget Priorities, Civil Rights, Fair taxation, Families, Healthcare

Senator Capito Votes for Senate Budget Resolution That Puts Health Care for West Virginia Families at Risk

The budget resolution sets up blueprint for tax cuts that mostly benefit wealthy households while cutting health care and education for everyone else. Senator Capito voted for the Resolution that could put Medicaid for 438,000 West Virginians at risk as well as Medicare for 416,000 seniors and people with disabilities. Time and time again, Senator Capito has shown that, despite what she says, her priorities are taking care of the wealthy and big business, not her constituents. More

Issues: Budget Priorities, Civil Rights, Fair taxation, Families, Healthcare

Action Alert CAG October 19, 2017

Tell Senators to Vote No on Harmful GOP Budget

Tonight's the night. The U.S. Senate will be debating a Budget Resolution that will set the framework for how much federal spending will be cut, with a vote expected very early Friday morning. Senators Capito and Manchin have a responsibility to stop this immoral scheme, which will disproportionately affect the most vulnerable among us. Call NOW and tell them to vote NO. More

Issues: Budget Priorities, Civil Rights, Economy, Fair taxation, Families, Healthcare, Workers

Tell Senators to Vote No on Harmful GOP Budget

Tonight's the night. The U.S. Senate will be debating a Budget Resolution that will set the framework for how much federal spending will be cut, with a vote expected very early Friday morning. Senators Capito and Manchin have a responsibility to stop this immoral scheme, which will disproportionately affect the most vulnerable among us. Call NOW and tell them to vote NO. More

Issues: Budget Priorities, Civil Rights, Economy, Fair taxation, Families, Healthcare, Workers

Press Release October 18, 2017

West Virginia Families Will Be Harmed by Proposed Senate Budget

The Republican’s proposed budget will be very harmful to West Virginia’s families if it becomes law. It slashes funding for vital services and programs such as Medicaid, Medicare and education in order to provide huge tax cuts to the wealthy and corporations while raising taxes many working families who are already struggling to make ends meet. Read our complete statement on this immoral scheme and its effects on West Virginia families. More

Issues: Budget Priorities, Fair taxation, Healthcare, Kids and families, Medicare, SNAP

West Virginia Families Will Be Harmed by Proposed Senate Budget

The Republican’s proposed budget will be very harmful to West Virginia’s families if it becomes law. It slashes funding for vital services and programs such as Medicaid, Medicare and education in order to provide huge tax cuts to the wealthy and corporations while raising taxes many working families who are already struggling to make ends meet. Read our complete statement on this immoral scheme and its effects on West Virginia families. More

Issues: Budget Priorities, Fair taxation, Healthcare, Kids and families, Medicare, SNAP

Action Alert October 12, 2017

Tell Senator Capito to Vote NO on Republicans’ Proposed Budget

We can't let Republicans use the budget to make the same devastating health care cuts that Americans overwhelmingly rejected during repeated efforts to repeal the Affordable Care Act. Please call Senator Capito today at 888-516-5820 and tell her to vote NO! More

Issues: Budget Priorities, Fair taxation, Healthcare, Kids and families, Medicare

Tell Senator Capito to Vote NO on Republicans’ Proposed Budget

We can't let Republicans use the budget to make the same devastating health care cuts that Americans overwhelmingly rejected during repeated efforts to repeal the Affordable Care Act. Please call Senator Capito today at 888-516-5820 and tell her to vote NO! More

Issues: Budget Priorities, Fair taxation, Healthcare, Kids and families, Medicare

Action Alert October 4, 2017

Call Congress: Vote NO on cuts to Medicare, Medicaid to Pay for Tax Cuts

On THURSDAY, OCT. 5, Congress will vote on a federal budget proposal that cuts Medicaid, Medicare and education and gives big tax breaks to the rich and corporations. Call your Representative NOW at 888-516-5820 and tell them to vote NO on the House budget resolution. More

Issues: Budget Priorities, Civil Rights, Fair taxation, Families, Healthcare

Call Congress: Vote NO on cuts to Medicare, Medicaid to Pay for Tax Cuts

On THURSDAY, OCT. 5, Congress will vote on a federal budget proposal that cuts Medicaid, Medicare and education and gives big tax breaks to the rich and corporations. Call your Representative NOW at 888-516-5820 and tell them to vote NO on the House budget resolution. More

Issues: Budget Priorities, Civil Rights, Fair taxation, Families, Healthcare

Action Alert, Newsletter article September 8, 2017

Capital Eye: Summer 2017 Edition

We leapt straight from the tough legislative session, including an extended budget battle, into several other state and national fights. Our crew rarely misses a beat in their efforts to bring justice and sanity to public policy. Keep reading for a post-legislative session overview. More

Issues: Budget Priorities, Energy efficiency, Event, Fair taxation, HCAN, Healthcare, Inequality, Medicare, Poverty, SNAP

Capital Eye: Summer 2017 Edition

We leapt straight from the tough legislative session, including an extended budget battle, into several other state and national fights. Our crew rarely misses a beat in their efforts to bring justice and sanity to public policy. Keep reading for a post-legislative session overview. More

Issues: Budget Priorities, Energy efficiency, Event, Fair taxation, HCAN, Healthcare, Inequality, Medicare, Poverty, SNAP

Newsletter CAG September 8, 2017

Capital Eye: Summer 2017 Vol.10 No.11

We leapt straight from the tough legislative session, including an extended budget battle, into several other state and national fights. Our crew rarely misses a beat in their efforts to bring justice and sanity to public policy. Keep reading for a post-legislative session overview. More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Energy, Fair taxation, Families, Healthcare

Capital Eye: Summer 2017 Vol.10 No.11

We leapt straight from the tough legislative session, including an extended budget battle, into several other state and national fights. Our crew rarely misses a beat in their efforts to bring justice and sanity to public policy. Keep reading for a post-legislative session overview. More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Energy, Fair taxation, Families, Healthcare

Citizen Action Group Blog CAG August 3, 2017

Join Us at the WV Grassroots Summit

This September, we hope you'll join us for a two-day planning and grassroots organizing summit in Buckhannon, WV. People all across our state are rising up to fight for equality for themselves, their families, and their neighbors - not for big donors on Wall Street. In West Virginia, we believe in freedom for all people regardless of gender, race, class, orientation, disability, or status. During our two day event, you will have the opportunity to join in on trainings, workshops, projects, networking opportunities, roundtable discussions, and more - if you are standing up for yourself, your family, and/or your community, this summit is for you! More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Fair taxation, Families, Healthcare

Join Us at the WV Grassroots Summit

This September, we hope you'll join us for a two-day planning and grassroots organizing summit in Buckhannon, WV. People all across our state are rising up to fight for equality for themselves, their families, and their neighbors - not for big donors on Wall Street. In West Virginia, we believe in freedom for all people regardless of gender, race, class, orientation, disability, or status. During our two day event, you will have the opportunity to join in on trainings, workshops, projects, networking opportunities, roundtable discussions, and more - if you are standing up for yourself, your family, and/or your community, this summit is for you! More

Issues: Budget Priorities, Civil Rights, Democracy, Economy, Fair taxation, Families, Healthcare

Citizen Action Group Blog CAG July 12, 2017

Power to the People

Our annual fundraiser and awards dinner, the Spring Fling, was a huge success! Thank you to all of our sponsors, silent auction contributors, those who attended and those who supported from afar. Citizen Action is only as powerful as the people and together we can make the necessary changes to live in a world that works for all of us! More

Issues: Budget Priorities, Civil Rights, Democracy, Fair taxation, Healthcare

Power to the People

Our annual fundraiser and awards dinner, the Spring Fling, was a huge success! Thank you to all of our sponsors, silent auction contributors, those who attended and those who supported from afar. Citizen Action is only as powerful as the people and together we can make the necessary changes to live in a world that works for all of us! More

Issues: Budget Priorities, Civil Rights, Democracy, Fair taxation, Healthcare

Citizen Action Group Blog Gary Zuckett July 7, 2017

Budget Battle Over (For Now)

West Virginia dodged the bullet at the last possible moment. However, this is not a budget to celebrate. It cuts higher education and Medicaid and doesn’t raise enough new revenue to keep this annual fight over cuts v. revenue from playing out again next year and into the future. More

Issues: Budget Priorities, Fair taxation

Budget Battle Over (For Now)

West Virginia dodged the bullet at the last possible moment. However, this is not a budget to celebrate. It cuts higher education and Medicaid and doesn’t raise enough new revenue to keep this annual fight over cuts v. revenue from playing out again next year and into the future. More

Issues: Budget Priorities, Fair taxation

Advocacy Letter June 13, 2017

Citizen Action Endorses Call for a Fair Budget from Congress in 2018

As work begins on the FY 2018 budget, organizations from West Virginia are calling on Congress to increase investments in public education, affordable housing, health and nutrition, public transit, roads and bridges, clean air, clean water, clean energy, child care, and other means of making investments in communities that also create good jobs. Congress must produce a budget that moves us towards more opportunity for all, that safeguards and advances our basic living standards, and that protects our environment. More

Issues: Budget Priorities, Fair taxation

Citizen Action Endorses Call for a Fair Budget from Congress in 2018

As work begins on the FY 2018 budget, organizations from West Virginia are calling on Congress to increase investments in public education, affordable housing, health and nutrition, public transit, roads and bridges, clean air, clean water, clean energy, child care, and other means of making investments in communities that also create good jobs. Congress must produce a budget that moves us towards more opportunity for all, that safeguards and advances our basic living standards, and that protects our environment. More

Issues: Budget Priorities, Fair taxation

Action Alert, Newsletter CAG April 2, 2017

Crossover Chaos! – The Capitol Eye Legislative Update for April 2, 2017

As mentioned last week, Wednesday the 29th was crossover day so the legislature worked through last weekend, started early mornings, and met late into the evenings to get as many of their must pass bills over to the other side. One notable ‘hail-Mary’ passage of a bill was SB 386, the Medical Cannabis bill that was taken up in the final Judiciary meeting and passed out of the Senate during the last floor session. More

Issues: Budget Priorities, Environment, Fair taxation, Families, Healthcare, Workers

Crossover Chaos! – The Capitol Eye Legislative Update for April 2, 2017

As mentioned last week, Wednesday the 29th was crossover day so the legislature worked through last weekend, started early mornings, and met late into the evenings to get as many of their must pass bills over to the other side. One notable ‘hail-Mary’ passage of a bill was SB 386, the Medical Cannabis bill that was taken up in the final Judiciary meeting and passed out of the Senate during the last floor session. More

Issues: Budget Priorities, Environment, Fair taxation, Families, Healthcare, Workers